When you're trying to figure out how to save for a child's education, the conversation almost always lands on two options: the Roth IRA and the 529 plan. It can feel like a tough choice because they're both fantastic, but they solve the problem from completely different angles.

At its core, the decision boils down to a classic trade-off: dedicated educational benefits versus long-term financial flexibility. The 529 plan is a finely tuned instrument, specifically designed for one job—funding education with some serious tax advantages. On the other hand, the Roth IRA is more like the Swiss Army knife of financial accounts. It's built for retirement, but its unique rules make it a surprisingly powerful backup plan for college costs.

This fundamental difference in purpose is what guides most families. A 529 plan is a state-sponsored account created solely for education expenses, while a Roth IRA is a personal retirement account. As SmartAsset.com explains, choosing between them really means deciding whether you prefer specialized tax breaks or ultimate versatility.

Roth IRA vs. 529 Plan At a Glance

To really see how these two accounts stack up, it helps to put them side-by-side. Think of this as the quick-start guide to understanding where each one shines and where it has its limits.

Here’s a look at their core features:

| Feature | Roth IRA | 529 Plan |

|---|---|---|

| Primary Purpose | Retirement Savings | Education Savings |

| Federal Tax on Withdrawals | Tax-free for qualified withdrawals | Tax-free for qualified education expenses |

| State Tax Deduction | No | Often available for contributions |

| Contribution Flexibility | Limited by annual IRA max & income | Very high lifetime limits, no income caps |

| Withdrawal Flexibility | High (contributions can be withdrawn anytime) | Low (penalty on non-qualified withdrawals) |

| Impact on Financial Aid (FAFSA) | Not reported as an asset | Reported as a parent asset (low impact) |

Looking at the table, you can see the clear divergence. The 529 is all-in on education, offering state tax perks and massive contribution room. The Roth IRA, while more restrictive on contributions, gives you an escape hatch—you can always pull your original contributions out for any reason, tax-free and penalty-free.

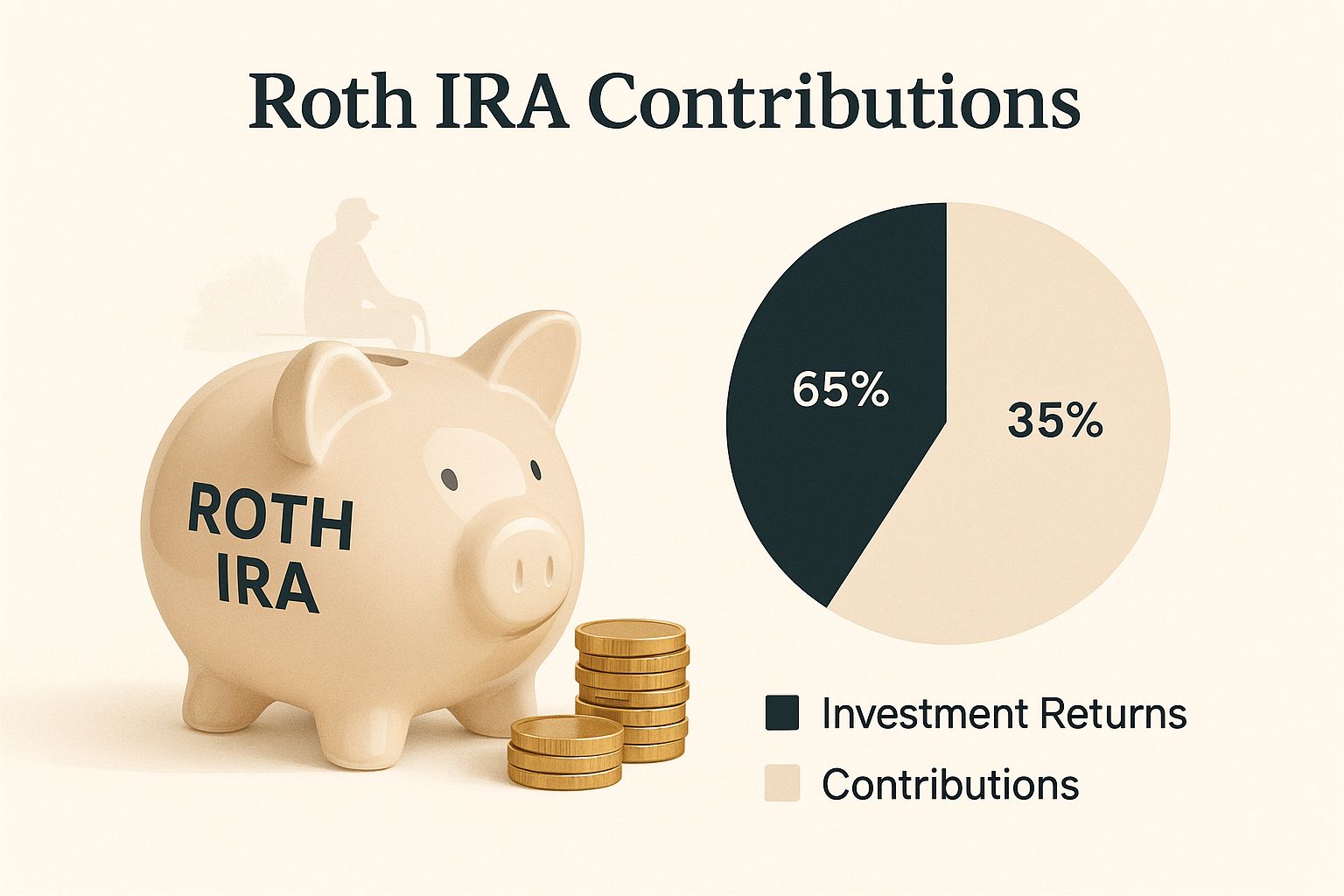

This image really drives home the point. The Roth IRA is fundamentally a retirement tool that just happens to have features that make it useful for other major life goals, like helping with a college bill. It’s a dual-purpose account, but its heart is in retirement.

How Each Account Works for Education Savings

To make a smart call in the Roth IRA vs. 529 debate, you have to get into the nitty-gritty of how each account actually operates. They might both be savings tools, but they follow completely different rulebooks. Those differences will shape how you contribute, invest, and, most importantly, pull money out for college.

A Roth IRA is, at its core, a retirement account. But a clever quirk in its rules creates a back-door strategy for funding education. Its biggest superpower is flexibility, though that flexibility comes with a few strings attached.

The Roth IRA Approach to College Savings

When you use a Roth IRA for education, you're really just taking advantage of rules that were designed for retirement. The whole game boils down to understanding the difference between your contributions (the cash you put in) and your earnings (the growth from your investments).

Here's the beautiful part: you can withdraw your direct contributions to a Roth IRA at any time, for any reason, completely tax-free and penalty-free. This is the single biggest reason to consider a Roth for college costs. It doubles as a safety net—if your child ends up not needing the money for school, it simply stays put for your retirement. No harm, no foul.

But things change a bit if you need to tap into the investment earnings to cover tuition.

Key Insight: You can withdraw Roth IRA earnings to pay for qualified higher education expenses without getting hit with the usual 10% early withdrawal penalty. However, you will have to pay regular income tax on that growth. This makes it a penalty-free option, but not a tax-free one.

This distinction is crucial. The IRS makes you pull out your contributions first. Only after you've withdrawn every single dollar you ever put in can you start touching the earnings. For many families, the contributions alone are enough to serve as a solid emergency fund for education.

Contribution and Income Rules for Roth IRAs

There are a few guardrails to keep in mind. The IRS caps how much you can put in each year. For 2025, that limit is $7,000 per person (or $8,000 if you're age 50 or older). This limit applies to all your IRAs combined, not just one account.

Your income also plays a role. Your ability to contribute directly is limited by your Modified Adjusted Gross Income (MAGI). For 2025, the contribution amount starts phasing out for single filers earning over $150,000 and for married couples earning over $236,000. And don't forget, for a child to have their own Roth IRA, they must have their own earned income. You can get the full scoop in our guide on the Roth IRA for minors rules.

The 529 Plan: A Dedicated Education Machine

Unlike the Roth IRA's dual-purpose nature, the 529 plan was built from the ground up for one mission: saving for education. This specialization is its greatest strength, giving it some seriously powerful tax advantages that are tough to beat if you’re sure the money will go toward school.

These are state-sponsored investment accounts, which just means each state offers its own version. The good news is you can typically invest in any state's plan, no matter where you live.

The defining feature of a 529 is its tax treatment. Here's how it breaks down:

- Your contributions might give you a state income tax deduction or credit, depending on where you live and which plan you use.

- Your investments grow federally tax-deferred, meaning no tax drag on your returns year after year.

- Withdrawals are 100% tax-free at the federal level (and usually state level, too) as long as you use the money for qualified education expenses.

This triple-tax advantage makes the 529 an incredibly efficient way to save for college. Better yet, there are no income limits to contribute, and the lifetime contribution limits are massive—often well over $500,000 per beneficiary.

Investment Options in a 529 Plan

Most 529 plans keep investing simple by offering a curated menu of options. One of the most popular choices by far is the age-based or target-date portfolio.

These portfolios are designed to be hands-off. They start aggressive and automatically become more conservative as your child gets closer to college.

- Ages 0-10: The portfolio is loaded up with stocks to chase maximum growth.

- Ages 11-17: It gradually shifts more money into bonds and safer assets to lock in gains.

- Ages 18+: The mix becomes very conservative, focused on protecting your capital right when you need it for tuition bills.

This set-it-and-forget-it approach takes the guesswork out of investing and helps ensure your strategy matures along with your child. The clear, powerful mechanics of the 529 make it a straightforward choice for families laser-focused on optimizing their education fund.

Comparing Tax Benefits and Contribution Rules

Let's get into the financial engine of these accounts. Both the Roth IRA and the 529 plan run on some powerful tax advantages, and this is where the comparison gets really interesting. While they both offer that amazing benefit of tax-free growth, how they handle contributions and withdrawals is completely different. This split is often what makes the Roth IRA vs 529 decision for you, depending on your goals and even where you live.

A 529 plan is built from the ground up to maximize tax breaks for education. Its killer feature is that withdrawals for qualified education expenses are 100% tax-free at the federal level and usually at the state level, too. That means every single dollar of growth can go straight to tuition, fees, or books without you ever seeing a tax bill for it.

A Roth IRA, on the other hand, only lets you pull out your original contributions tax-free when you use them for college. If you need to touch the investment earnings, that money gets taxed as regular income, though you do get to skip the 10% early withdrawal penalty. This distinction alone makes the 529 a much more tax-savvy tool for paying the actual college bills.

The State Tax Deduction: A Key 529 Advantage

Here’s a perk a Roth IRA simply can’t touch: a potential state income tax deduction or credit. More than 30 states, including the District of Columbia, will give you a tax break just for putting money into your home state's 529 plan.

This is a direct, immediate win for your finances. For instance, if you live in a state with a 5% income tax rate, contributing $10,000 to your 529 could shave $500 off your state tax bill. You've essentially locked in a guaranteed 5% return on your money right out of the gate. A Roth IRA offers nothing like this upfront.

Key Differentiator: The state tax deduction for 529 contributions can put real money back in your pocket today. For parents in a participating state, this gives the 529 a major financial leg up over a Roth IRA and is a critical point to consider.

Contrasting the Contribution Frameworks

The rules on how much money you can actually put into these accounts couldn't be more different. This is where the 529 really flexes its muscles, offering a savings capacity that a Roth IRA just wasn't designed for.

Roth IRAs are held back by strict annual limits from the IRS. For 2025, you can only contribute up to $7,000 (or $8,000 if you're 50 or older). Plus, these contributions are gated by income limits, meaning high earners can't contribute at all.

Then there’s the 529 plan, which has no annual contribution limit set by the plan itself and no income restrictions on who can contribute. Instead, its massive limits—often over $500,000 per beneficiary—are guided by federal gift tax rules.

This opens the door for some seriously aggressive savings strategies, like "super-funding."

- Standard Gift: Each year, you can give up to the annual gift tax exclusion ($18,000 in 2024) to anyone you want without needing to file a gift tax return.

- 529 Super-funding: You can make five years' worth of gifts all at once. That means you can drop up to $90,000 (or $180,000 for a married couple) into a 529 plan in a single year, tax-free.

This super-funding move is a game-changer for grandparents or parents who want to give a child’s college fund a massive head start. You simply can't front-load an investment like that with a Roth IRA. It perfectly illustrates the trade-off: the Roth IRA gives you flexibility, but the 529 offers unparalleled contribution power and tax efficiency for education.

Withdrawal Rules and Account Flexibility: How Easy Is It to Get Your Money?

This is where the rubber meets the road. How easily can you tap into your savings if you need the money? This single question gets to the core of the Roth IRA vs. 529 debate, because the two accounts couldn't be more different when it comes to liquidity and control.

Your decision here really boils down to a classic trade-off: do you want a laser-focused, tax-optimized tool for education, or do you prefer ultimate financial flexibility?

The Roth IRA is the undisputed champion of flexibility. Its most compelling feature is that you can withdraw your direct contributions—the money you put in—at any time, for any reason, without owing a dime in taxes or penalties. This one rule completely changes the game, turning the Roth IRA into a powerful, multi-purpose financial vehicle.

Think of it as a supercharged savings account. If your kid needs help with a down payment on their first car, an unexpected medical bill pops up, or you simply need cash for something totally unrelated to school, your contributions are there for the taking. For parents who value having a financial safety net, this level of access is a massive advantage.

The Trade-Off: A 529 Plan’s Guardrails

A 529 plan, on the other hand, is built with much stricter guardrails. Its incredible tax benefits are directly linked to using the money for qualified education expenses. If you pull funds out for any other reason, it’s considered a non-qualified withdrawal, and that’s where things get tricky.

A non-qualified withdrawal usually comes with two hits:

- Income Tax: The earnings portion of the withdrawal gets taxed at your ordinary income tax rate.

- Federal Penalty: On top of that, you'll get slapped with a 10% federal penalty on those same earnings.

This structure is there for a reason: to make sure the money is preserved for its intended purpose. It’s highly effective at keeping the funds locked in for school, but it severely cramps your style if your family’s financial situation changes and you need that cash for something else.

Key Takeaway: A Roth IRA is a fantastic emergency fund because you can access your contributions penalty-free. A 529 plan is far less flexible; its penalty structure for non-qualified withdrawals makes it a poor choice for anything other than education expenses.

What if Your Kid Gets a Scholarship?

Here’s a common real-world scenario that perfectly illustrates the difference. Your child works hard and earns a generous scholarship—fantastic news! But it can throw a wrench in your savings plan if you’ve been diligently socking money away in a 529.

Luckily, the IRS gives you a break here. If your child wins a scholarship, you can withdraw an amount equal to the scholarship from your 529 plan without getting hit with the 10% penalty. But there's a catch: you'll still owe income tax on the earnings portion of that withdrawal. With a Roth IRA, you could still pull out all your contributions completely tax- and penalty-free.

This highlights the true nature of each account. The 529’s tax benefits are powerful but conditional. And with strong market performance, the tax hit can be significant. Some of the best-managed plans have seen impressive growth—as of early 2025, Maryland's college savings plan led the pack with a 7.04% average annual return. You can check out more performance data on the top-ranked 529 plans on SavingforCollege.com.

Ultimately, it comes down to what you prioritize. If you’re confident the money is headed for a college bill and you want to maximize every cent of tax-free growth, the 529 is tough to beat. But if you crave flexibility and want an account that can pull triple duty for retirement, education, and emergencies, the Roth IRA’s unmatched liquidity makes it a very compelling choice.

How Each Account Impacts Financial Aid Eligibility

When you're weighing a Roth IRA against a 529 plan, there's a critical factor that often gets missed: financial aid. How these accounts are treated on the Free Application for Federal Student Aid (FAFSA) can dramatically change the amount of aid your child receives.

Getting this right is a huge piece of the puzzle. A smart college savings strategy shouldn't accidentally torpedo your child's shot at need-based grants, scholarships, or loans. The rules are completely different for each account, and knowing them can save you thousands.

The 529 Plan and FAFSA Reporting

For a 529 plan, its impact on financial aid really boils down to one question: who owns it? Most of the time, that's a parent.

When a parent owns the 529 plan, the balance is reported as a parental asset on the FAFSA. That might sound like bad news, but it’s not. Parental assets are assessed at a much friendlier rate than assets owned by the student. Right now, only a maximum of 5.64% of the 529's value is counted toward the Student Aid Index (SAI), which is the new formula that replaced the old Expected Family Contribution (EFC).

Key Insight: A parent-owned 529 has a surprisingly small effect on financial aid. For every $10,000 you've saved in a parent's 529, your child's aid eligibility might only decrease by up to $564.

Even better, when you take a qualified distribution from that 529 to pay for college, the money is not counted as student income on the next year's FAFSA. This is a huge improvement over the old rules and means you can actually use the money without a penalty down the line.

What if a grandparent owns the 529? Thanks to the recent FAFSA Simplification Act, distributions from these accounts are also no longer counted as untaxed student income, which removes a major roadblock they used to have. The account value itself isn't reported on the FAFSA at all.

The Roth IRA’s FAFSA Advantage

This is where the Roth IRA really pulls ahead in the financial aid game. The value of your Roth IRA—or any of your retirement accounts, for that matter—is not reported as an asset on the FAFSA. Period. This is a massive advantage. You could have a ton of money saved in a Roth, and as far as the FAFSA is concerned, it's invisible.

This special treatment means you can save aggressively for your own future, using the Roth as a potential backup for college, without hurting your child's chances for need-based aid. If you want to dive deeper into setting up one of these accounts for your kids, our guide on the custodial Roth IRA is a great place to start.

But there’s a big "gotcha" you need to know about.

The Roth IRA Withdrawal Nuance

While the assets in a Roth IRA are hidden from the FAFSA, the withdrawals are not. When you pull money from a Roth to pay for college, that withdrawal amount gets reported as untaxed income for the student on a future FAFSA.

- Example: Let's say you withdraw $15,000 from your Roth in 2025 to cover your child's sophomore year. That $15,000 will pop up as income on the 2027-2028 FAFSA (which looks at 2025 income).

This can be a big deal. Student income gets assessed at a much higher rate than parental assets—up to 50%—so that withdrawal could seriously dent their aid package for their senior year. A popular workaround is to save the Roth IRA funds for the last couple of years of college, after the final FAFSA has already been filed.

For a long time, the biggest fear with a 529 plan was simple: what happens if my kid doesn't need all this money for college? A recent change in the law has created a fantastic safety net, making the 529 plan a more flexible tool than ever before.

This new provision creates a strategic bridge between education savings and retirement by allowing you to roll over leftover 529 funds into a Roth IRA for the same beneficiary. It’s a huge relief for parents worried about overfunding an account, or for situations where a child gets a big scholarship or decides college isn't for them.

Key Rules for the 529 to Roth IRA Rollover

This new feature is a game-changer, but it’s not a free-for-all. The rules are strict, and you have to follow them perfectly. Starting in 2024, you can move unused 529 funds to a Roth IRA for the same beneficiary without facing taxes or penalties, but only if you meet some very specific conditions.

This option came out of legislation signed into law in late 2022, and it provides a much-needed off-ramp for these dedicated education accounts. You can dig into the finer details by checking out this analysis of how 529 plans can help you save for the future.

To make a tax-free and penalty-free rollover happen, you have to check all of these boxes:

- 15-Year Rule: The 529 account must have been open for at least 15 years.

- 5-Year Contribution Rule: Any money (and its earnings) put into the account in the last five years is not eligible for the rollover.

- Beneficiary Match: The 529 beneficiary has to be the same person who owns the Roth IRA.

- Lifetime Cap: There’s a lifetime rollover limit of $35,000 for each beneficiary.

How the Rollover Works in the Real World

The amount you can roll over each year is limited by the beneficiary's annual Roth IRA contribution limit. This means you can't just move the full $35,000 at once. The rollover essentially is their Roth IRA contribution for that year, and they must have earned income to be eligible.

Let’s walk through an example. Your daughter, now 25, has a 529 account you opened 16 years ago. She finished college with little debt and has $40,000 left in the account. She's now working and earning $60,000 a year.

- Year 1: She can roll over an amount up to the annual Roth IRA contribution limit (let's say it's $7,000) from her 529 into her own Roth IRA. This counts as her Roth contribution for the year.

- Year 2: She can do it again, rolling over another $7,000.

- And so on: She can repeat this process each year until she hits that lifetime cap of $35,000.

Think of this as a strategic tool for leftover funds, not a backdoor way to fund a Roth IRA. Trying to overfund a 529 on purpose just to roll it over is a bad plan. The 15-year waiting period and slow, annual rollover process make it highly inefficient.

At its core, this feature is a powerful relief valve. It ensures the money you carefully saved for your child’s future doesn't get hit with penalties if their path takes a wonderful, but unexpected, turn. It adds a layer of flexibility that makes the 529 plan far more adaptable.

Frequently Asked Questions About College Savings

As you start digging into the Roth IRA vs. 529 debate, a lot of "what if" scenarios naturally pop up. Getting straight answers to these common questions is key to finalizing your savings strategy and moving forward with confidence.

So, can you have both a 529 and a Roth IRA? Absolutely. In fact, using them in tandem can be an incredibly powerful approach. Many families treat the 529 as their primary college fund to get the tax-free growth and potential state tax deductions, while simultaneously funding a Roth IRA as a flexible backup plan and, of course, a retirement account.

What Happens If My Child Gets a Scholarship?

First off, congratulations! That's fantastic news, and the rules offer some welcome flexibility. If your child wins a scholarship, you're allowed to withdraw an equivalent amount from their 529 plan without getting hit with the usual 10% penalty on the earnings. You will, however, still owe income tax on the earnings portion of that withdrawal.

This is where the Roth IRA really shines. With a Roth, you could simply pull out your original contributions—for any reason—completely free of taxes and penalties. It’s a perfect illustration of the fundamental difference in flexibility between these two accounts.

Can I Use a 529 for K-12 Tuition?

Yes, you can. The federal government allows you to use up to $10,000 per year from a 529 plan to cover tuition for K-12 public, private, or religious schools. Just be careful here, as the state tax rules for K-12 withdrawals can vary widely, so it's always smart to check your local regulations first.

Key Consideration: If you're not entirely sure your child will go to college, the Roth IRA often has the upper hand. Its flexibility is unmatched—your contributions can be withdrawn for any reason, penalty-free. If college doesn't happen, the money simply stays put, growing for your own retirement. It’s the ultimate financial safety net.

While the new 529 to Roth IRA rollover offers a great escape hatch for leftover funds, the Roth IRA's immediate, penalty-free access to your contributions is a huge advantage when you're facing uncertainty about future education plans.

Ready to give your child a head start on a secure financial future? At RothIRA.kids, we provide the tools and guidance you need to open and manage a Roth IRA for your minor. Explore our free guides and interactive tools at https://rothira.kids and start building generational wealth today.