When it comes to teaching your kids about money, it really just boils down to four key actions: earning, saving, spending wisely, and giving. The best way to get these concepts to stick is to weave them into your family’s daily life through hands-on activities and open, honest conversations. This is how you build real financial confidence from a young age.

Why Teaching Kids About Money Is Essential

Starting money conversations early sets your child up for a life of financial confidence, not confusion. These aren't just lessons about dollars and cents; they build character. They teach patience, responsibility, and the incredibly valuable skill of making smart decisions.

Forget about stuffy lectures. The most powerful lessons happen in everyday moments. A simple trip to the grocery store can easily become a practical exercise in budgeting and trade-offs. When you frame financial education as an empowering part of your parenting, you’re laying the groundwork for their future security. It’s not about creating little Wall Street prodigies overnight, but about planting the seeds of good habits that will grow with them.

Building Foundational Skills Early

If there's one thing to take away, it's this: start early. Kids who get a handle on basic money management before they turn 12 are far more likely to develop strong saving and budgeting habits as adults.

In fact, research shows that 72% of children aged 8 to 11 who get and manage an allowance show improved financial decision-making later in life. This early exposure demystifies money, turning it from something scary or confusing into a tool they can understand and control. You can learn more about the global impact of these early education initiatives from the World Bank.

The Four Pillars of Financial Literacy

To teach kids about money in a way that actually makes sense to them, it helps to focus on four foundational pillars. Each one builds on the last, creating a solid, real-world understanding of how money works.

Here’s a quick breakdown of these core concepts and how you can introduce them.

| Pillar | Key Lesson | Simple Activity |

|---|---|---|

| Earning | Money comes from work and effort. | Assign age-appropriate chores with a clear payment amount for completion. |

| Saving | Delaying gratification helps you reach bigger goals. | Use a clear jar so they can physically see their savings grow toward a specific toy or goal. |

| Spending Wisely | Making thoughtful choices about needs vs. wants. | Give them a small budget at the store and let them decide how to spend it. |

| Giving | Money can be used to help others and make a difference. | Have them set aside a small portion of their allowance to donate to a cause they care about. |

By getting a feel for these four concepts, kids gain a much more balanced perspective. They learn that money is a resource to be managed thoughtfully—not just for getting stuff, but for building the life they want and helping their community.

By mastering these four concepts, children gain a balanced perspective. They learn that money is a resource to be managed thoughtfully, not just for personal gain but for creating the life they want and helping their community.

To see how these ideas fit together into a bigger picture, our comprehensive guide on financial literacy for kids provides a detailed roadmap.

Think of it this way: letting your child make a small mistake with a $10 allowance is a safe, low-stakes learning experience. Letting them make their first mistakes with a credit card at 18 is a whole different story. You’re giving them a safe space to practice, fail, and learn with you right there to guide them. This approach ensures they step into adulthood prepared, not panicked.

Building Money Habits in Early Childhood (Ages 3-7)

For a little kid, money is pure magic. It's an abstract idea they see when you swipe a card or tap your phone. To make any sense of it, lessons for kids aged 3 to 7 have to be tangible, visual, and connected directly to their world. This is the perfect age to build the physical muscle memory of handling and saving money.

Our goal here isn't to explain complex financial topics. It's about creating foundational experiences that link effort to reward and choice to outcome. This early, hands-on practice is how you teach kids about money in a way that actually sticks, creating positive habits that can last a lifetime.

Make Saving Visible and Exciting

First things first: forget the classic, opaque piggy bank. For a young child, out of sight is truly out of mind. The single most effective tool for teaching saving is something they can see.

Grab a clear jar for their savings. When they get a dollar for helping set the table or a few coins for their birthday, they can physically drop the money in and watch the pile grow. That simple visual is incredibly powerful for a preschooler’s brain. It turns the fuzzy idea of "saving up" into a concrete reality.

A study found that children's cognitive abilities, including their understanding of concepts like saving, develop significantly between ages 3 and 5. Using a clear jar makes the abstract concept of accumulation tangible and understandable for their developing minds.

To really ramp up the excitement, tape a picture of their savings goal to the outside of the jar. It could be a small toy car, a special coloring book, or a trip for ice cream. Every single coin they add brings them visibly closer to that goal, teaching patience and delayed gratification in a way words never could.

Create a Direct Link Between Effort and Earning

One of the most crucial lessons is that money comes from effort. Tying simple, age-appropriate chores to a small payment forges a direct, undeniable connection between work and reward. These aren't their regular family contributions, like putting away their own toys, but extra "jobs" that go above and beyond.

A few ideas for paid chores for this age group:

- Watering the plants: A simple task that teaches responsibility.

- Matching socks: Turns a chore into a fun sorting game.

- Helping feed a pet: Gives them a real sense of importance.

- Wiping the table after a meal: A quick job with a clear beginning and end.

The key is to make the payment immediate and consistent. As soon as the job is done, hand them the coin or dollar bill and walk with them to put it straight into their clear jar. This immediate feedback loop is absolutely essential for young kids.

Practice Choices with Real-World Scenarios

Your everyday life offers the best classrooms. Trips to the grocery store and even playtime can be perfect opportunities to introduce the concepts of needs, wants, and making choices with a limited budget.

Turn Your Living Room Into a Store

Set up a "store" at home using some of their toys and a few healthy snacks. Put simple price tags on each item—1 coin, 2 coins—and give them a small handful of coins to "spend." This simple game immediately forces them to make choices. Do they want the apple for one coin or the small toy car for two? They can't have both.

This playful activity teaches a fundamental economic principle: scarcity. They learn that their money is finite and they have to prioritize what they want most.

Navigate Needs vs. Wants at the Grocery Store

The grocery store is a real-world classroom buzzing with teaching moments. When your child inevitably begs for that colorful box of sugary cereal, you can use a simple script to guide the conversation.

Example Conversation Script:

- Child: "I want that! Can we get it?"

- You: "That does look fun! Let's think. Is that a 'need' like the milk and bread we have to get for our meals, or is it a 'want,' something extra and fun?"

- Child: "It's a want."

- You: "Okay, it's not on our list for today. But if you really want it, you can use some of the money from your own jar to buy it."

This dialogue is empowering. It shifts the dynamic from a frustrating "No, because I said so" to a logical choice they get to control. They might decide the cereal isn't worth their hard-earned savings, or they might decide it is—either way, they are learning a priceless lesson about the true cost of their wants.

Navigating Allowances and Savings Goals (Ages 8-12)

Once kids hit the 8 to 12-year-old range, their brains are ready for more. We can move beyond simple piggy banks and start introducing real-world money management systems. This is the perfect age to transform a simple allowance into a hands-on financial training ground, essentially letting them run their own tiny, personal economy.

The point isn't just to hand over cash. It's about giving them a framework to manage it. You're teaching them how to handle money in a way that mirrors adult financial life, just on a much smaller and safer scale. This is their first real taste of financial autonomy.

Implementing the Save, Spend, Share Method

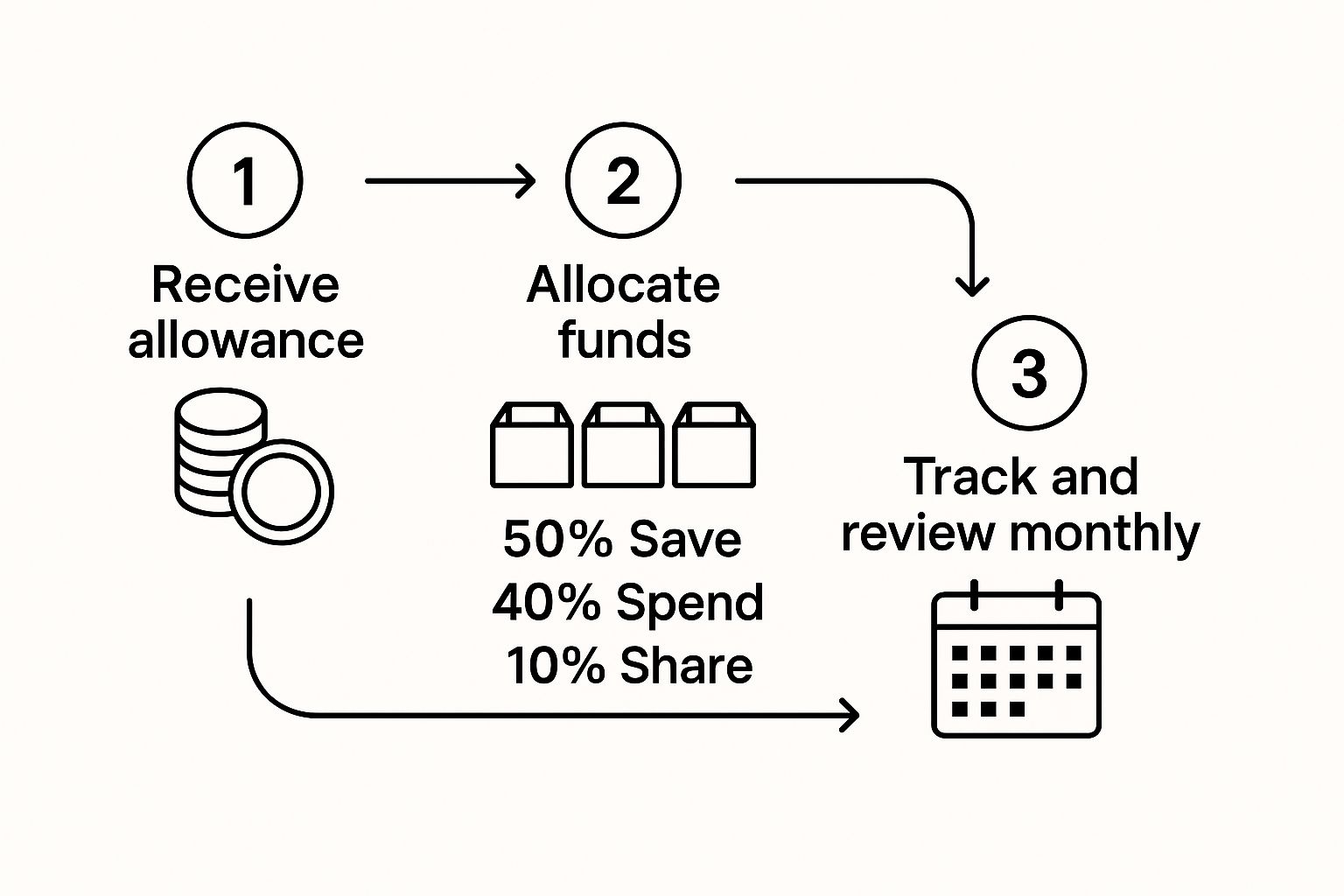

One of the best systems I've come across for this age group is the Save, Spend, Share method. It’s incredibly straightforward but powerful. Instead of getting a lump sum to blow on whatever they want, this method introduces budgeting by having them split their money into three distinct pots—just like we do with our paychecks.

It’s a subtle but profound shift in thinking. Money stops being just a tool for buying things and becomes a resource with different jobs. You’re hitting three core principles at once: budgeting, saving for goals, and philanthropy.

A great starting point for the split is:

- 50% for Spending: This is their "fun money." It’s for the immediate wants—the snacks, small toys, or movie tickets with friends. This gives them the freedom to make their own choices and, importantly, learn from them.

- 40% for Saving: This chunk is earmarked for bigger, long-term goals. This is the money that teaches the incredible power of delayed gratification and patience.

- 10% for Sharing: Setting aside a small portion for giving—whether to a local animal shelter, a friend's fundraiser, or a cause they've learned about—builds empathy and a sense of community responsibility.

The magic isn't in the exact percentages. It’s in the habit of intentional allocation. By physically separating their money into three jars or envelopes, kids learn that every dollar has a purpose before it gets spent.

For instance, with a $10 weekly allowance, they would immediately put $5 in their "Spend" jar, $4 in "Save," and $1 in "Share." Doing this every single week builds an automatic financial planning habit that can last a lifetime.

As this visual shows, managing money becomes a repeatable cycle, not just a one-off decision. This is how you lay the foundation for consistent, healthy financial habits.

Guiding Their First Big Savings Goal

With a system in place, that "Save" jar quickly becomes a launchpad for teaching delayed gratification. This is your chance to help your child set their very first significant savings goal. It needs to be something they really want, something that feels just a little out of reach for their weekly "Spend" money.

Maybe it's a $100 bicycle, a $60 video game they've been eyeing, or a $40 LEGO set. The item itself doesn't matter as much as the process. Sit down with them and do the math. If they save $4 a week, how long will it take to reach their goal? Realizing it will take 25 weeks to get that bike makes the timeline concrete and the goal feel achievable.

This is often a profound learning experience. A child who saves for six months to buy their own bike will value it far more than one they just received as a gift. They feel an incredible sense of pride and ownership. As one young adult shared about a backpack she saved for at age 6, "I loved that backpack. I took it everywhere… my sense of pride made me want to continue on this path."

Navigating Their First Independent Purchases

When the big day finally arrives—either to spend from the "Spend" jar or to cash in their savings goal—your job as a guide isn't over. Go with them to the store, but let them handle the entire transaction. This is a critical moment.

Let them be the one to hand the money to the cashier and get the change back. It makes the exchange real. And here’s the hard part: resist the urge to step in if you think they're making a "bad" choice. Trust me, buying a cheap toy that breaks in a day is a much more powerful lesson in value and quality than any lecture you could ever give. A low-stakes mistake made with their own money is an invaluable investment in their future financial wisdom.

Time for Takeoff: Guiding Your Teen Toward Financial Independence (Ages 13+)

The teenage years are the ultimate dress rehearsal for adulthood. As your kid’s world cracks open with new freedoms, new responsibilities, and maybe even a first job, their financial world needs to expand right along with it. This is our moment to help them shift from piggy banks and cash jars to the real-world digital tools they’ll be using for the rest of their lives.

Think of yourself less as a teacher and more as a financial coach. You’re on the sidelines, offering guidance as they start making bigger decisions and learning from the consequences—all within a safe, controlled environment.

Their First Real Bank Account

Opening a student checking account is a non-negotiable first step. It transforms money from a tangible thing they can hold into the digital concept they need to master. Seeing cash disappear from an envelope is one thing; learning to track a balance on an app after a few thoughtless purchases is a whole different (and more valuable) lesson.

Look for a student account at a local bank or credit union—most offer options with no monthly fees and low (or zero) minimum balances. Don't just sign the papers and hand them the card. Sit down together and actually explore the bank's mobile app. Show them how to check their balance, see where their money went, and set up low-balance alerts. This small tour demystifies banking and gives them a powerful sense of ownership.

A checking account with a debit card is the perfect training ground. It provides freedom within safe boundaries. Your teen can only spend what they have, eliminating the risk of debt while they learn to budget for their own expenses.

This account should become their financial hub. Funnel everything in here: allowance, birthday money from Grandma, and especially paychecks from a part-time job. This forces them to manage their cash flow digitally, a skill that's absolutely essential for modern life.

The Inevitable Debit vs. Credit Card Talk

Their first debit card is a huge milestone. It’s also the perfect time for a crystal-clear conversation about the two types of plastic.

- A Debit Card is tied directly to their checking account. Think of it as digital cash. If there's $50 in the account, they can spend exactly $50. End of story. It's an incredible tool for learning to live within your means.

- A Credit Card is a loan. When they swipe it, they're borrowing money from a bank that has to be paid back, usually with interest. We need to explain that this is a tool for building a credit history later on, but it carries serious risk if you're not disciplined.

For now, the debit card is their practice field. I once heard a young adult say that accidentally draining her debit card on clothes and needing a small loan from her parents was the best lesson she ever learned—no long-term credit damage, just a very real understanding of budgeting for wants vs. needs.

Earning a Paycheck and Actually Understanding It

A first job is a game-changer. It’s not just about the money; it's their first real glimpse into the working world. When that first pay stub arrives, don't let them toss it aside.

Sit down and dissect it together. This is your chance to make abstract concepts real.

Show them the difference between gross pay (the big number they thought they were getting) and net pay (the reality of what hits their account). Point out the deductions for things like FICA (that’s Social Security and Medicare) and federal or state taxes. Suddenly, taxes aren't just a boring topic from social studies class—it's their money. That’s a lesson that sticks.

Unlocking the Magic of Investing and Compound Interest

Once your teen has earned income, you can introduce them to one of the most powerful wealth-building tools on the planet: investing. The goal here isn't to turn them into Wall Street whizzes overnight but to plant a seed that can change their entire financial future.

The key is to demystify compound interest. I always explain it as "money making babies." If they invest $100 and earn 10%, they have $110. The next year, that 10% is earned on the full $110, not just the original $100. It's a tiny snowball that, given enough time, can turn into an avalanche of wealth.

This isn't just a nice theory. The S&P 500, a benchmark for the U.S. stock market, has historically delivered average annual returns of around 12% over the long haul. While past performance is no guarantee, it shows the incredible power of staying invested over time. You can find more info on using historical data to inform your money conversations and make these concepts tangible.

This is exactly why opening a custodial Roth IRA with their first paycheck is so impactful. Even a few hundred dollars from a summer lifeguarding job can grow into a staggering sum over 50 years, giving them a head start that most adults can only dream of.

Helpful Tools and Resources for Parents

Here's the good news: you don't need to be a financial guru to raise a money-smart kid. An entire ecosystem of tools has sprung up to make learning about money interactive, tangible, and honestly, a lot more fun. Knowing which ones to grab can turn abstract concepts into real, hands-on skills for your child.

The right tool can bridge the gap between your dinner-table chats about money and how it all works in the real world. This is more important than ever. Globally, access to formal education has its challenges—as of 2024, an estimated 251 million children and youth are out of school, which means they miss out on any kind of financial literacy training. You can see the full global education stats from UNESCO.

These resources help fill that gap, giving you a ready-made toolkit to bring your money lessons to life.

Engaging Financial Apps for Kids

In a world where kids are digital natives, financial apps are a brilliant way to teach budgeting, saving, and even investing in a format they already know and love. Many come with a debit card, giving kids firsthand experience managing digital money while you keep a watchful eye.

These apps take chores and allowance from a static chart on the fridge to a dynamic system of earning and tracking. It's a natural evolution from the piggy bank or the three-jar system. More importantly, they create a safe sandbox for kids to practice making financial decisions with real, but limited, money.

Comparison of Popular Kids' Money Apps

Choosing an app can feel overwhelming, but they each have their own strengths. This quick comparison should help you pinpoint which one might be the best fit for your family’s goals and your child’s age.

| App Name | Best For Ages | Key Features | Cost Structure |

|---|---|---|---|

| Greenlight | 6-18 | Parent-managed debit card, chore management, custom savings goals, and an investing platform for kids. | Monthly subscription fee. |

| GoHenry | 6-18 | Customizable debit card, financial missions (short lessons), spending limits, and real-time notifications. | Monthly fee per child. |

| BusyKid | 5-17 | Chore chart that auto-pays allowance, options to save, spend, donate, or invest in real stocks. | Annual subscription fee. |

| Current | Teens (13+) | Teen bank account with debit card, budgeting tools, savings pods, and direct deposit for first jobs. | Free basic plan available. |

Each of these platforms offers a unique way to turn abstract financial lessons into concrete actions, moving your kids from theory to practice.

Books That Make Money Lessons Stick

While apps are fantastic for the "how," books are unbeatable for teaching the "why." A good story can provide the narrative and emotional context behind financial concepts, illustrating the value of patience, the joy of giving, or the reward of hard work in a way a simple transaction can't.

Reading together also opens the door for amazing conversations. You can pause and ask, "What would you have done?" or "Why do you think the character made that choice?" This simple act helps your child connect the story’s lessons directly to their own life.

- For Ages 4-8: Picture books like "Alexander, Who Used to Be Rich Last Sunday" by Judith Viorst are perfect. It hilariously captures the pain of watching your money vanish—an unforgettable lesson on impulsive spending.

- For Ages 9-12: Chapter books like "The Lemonade War" by Jacqueline Davies do a great job of weaving concepts like competition, marketing, and profit into a storyline that kids actually find compelling.

A powerful story can frame financial literacy not as a set of rules, but as a series of choices that shape your life. It transforms the "how" of money management into the "why," which is a far more compelling lesson for a child to learn.

Interactive Websites and Games

Want to make screen time more productive? There are some excellent websites out there offering free games and simulations that make learning about money feel like play. These are fantastic for reinforcing the ideas you're already talking about at home.

PBS Kids, for instance, has a great collection of games that teach basic economic principles through characters your kids already know and love. For older kids and teens, you can find stock market simulators that let them "invest" with fake money. It’s a brilliant, risk-free way to watch how the market works.

These tools are especially powerful for demystifying complex topics. Trying to explain compound interest can make anyone's eyes glaze over. But letting a teen use a simulator to see their "money" grow exponentially over time? That's a lesson that clicks. When you feel they're ready for the real thing, our guide on investing for minors can help you make the leap from a simulation to a real custodial account.

Answering Your Top Money Questions

Even with the best game plan, teaching kids about money will always throw a few curveballs. You'll run into tricky, real-world questions that don’t have clean, textbook answers. Every family is different, and what clicks for one kid might not work for another. This is where we get past the general advice and tackle the tough, specific dilemmas you’re probably facing.

Let's be honest, these aren't just logistical hurdles. They're often tangled up in our own emotions and histories with money. Below, I’ll give you some direct, empathetic, and actionable answers to the questions I hear most often from parents. The goal is to give you the confidence to handle these moments with clarity and purpose.

When Is the Right Age to Start an Allowance?

There’s no magic number here. The best time to start an allowance is simply when your child starts to grasp that money is exchanged for things. For most kids, this lightbulb goes on somewhere between ages 5 and 7. The key isn't the specific birthday but linking the money to a real purpose.

An allowance shouldn't just feel like a handout—it’s a teaching tool. Right from the start, connect it to the 'Save, Spend, Share' system we talked about earlier. Doing this immediately frames money as something to be managed, not just a ticket to the candy aisle.

The most effective allowance systems are less about the dollar amount and more about the consistency and the conversations. It’s the weekly ritual of divvying up the money and talking about goals that builds real financial muscle memory.

How Do I Talk About Our Finances Without Causing Fear?

This is a delicate balancing act. You want to be honest, but you absolutely don't want to saddle your kids with adult-sized stress. The secret is to focus on values and behaviors instead of specific dollar amounts. Your kids don’t need to know your salary or the size of your mortgage.

Instead, talk about the choices you make as a family.

- "We're choosing not to get takeout this week so we can put that money toward our family vacation fund."

- "We drive an older car because we'd rather use that money for our retirement savings."

- "We always look for coupons before we go to the store because finding a good deal feels smart."

This approach models responsible financial behavior without revealing sensitive numbers. It teaches them that managing money is all about making intentional decisions that line up with your family’s goals—an empowering lesson, not a scary one.

What if My Child Wastes Their Money?

First, take a deep breath. It’s going to happen, and frankly, it’s one of the most valuable lessons they can learn. A cheap toy that breaks in an hour is a far more powerful teacher than any lecture you could ever give.

Your gut reaction might be to say, "I told you so." Resist that urge. Instead, turn it into a calm, reflective conversation a little later.

Here’s how that might sound:

- You: "How are you feeling about that toy you bought yesterday?"

- Child: "It was fun for a minute, but it already broke."

- You: "That's a bummer. What do you think you'll do differently next time you have spending money?"

This simple exchange guides them toward self-correction. Experiencing a bit of buyer’s remorse with a $5 toy is an incredibly cheap—and priceless—investment in their future financial wisdom.

How Can I Teach This if I'm Not Confident Myself?

This is maybe the most important question of all. You absolutely do not need to be a financial guru to be a great money teacher for your kids. In fact, being open about your own learning journey can be incredibly powerful.

Frame it as a team effort. You can literally say, "You know, I'm learning more about how to be smart with money, and I want us to learn together." This kind of vulnerability builds trust and shows them that financial literacy is a lifelong skill, not something you’re supposed to have mastered overnight. Use the tools and resources out there—you can explore them right alongside your child, making it a shared adventure.

Ready to give your child the ultimate head start on their financial future? At RothIRA.kids, we provide a free, easy-to-follow starter guide that demystifies the process of opening a Roth IRA for your child. Explore our tools and see how early entrepreneurship and investing can build a foundation for generational wealth. Start building their future today at RothIRA.kids.