Think about planting a tiny seed that, with a little care, grows into a massive tree your child can enjoy for decades—and all the fruit it bears is completely tax-free. That, in a nutshell, is the magic of a Custodial Roth IRA. It’s a special investment account set up for a minor but managed by an adult, designed to turn a child's first paychecks into a serious nest egg down the road.

The Foundation of Early Wealth Building

At its heart, a Custodial Roth IRA is a retirement account for kids, but it’s so much more than that. It's a powerful financial tool that combines a child's early earnings with the incredible force of long-term, tax-free growth.

Unlike a simple savings account that barely keeps pace with inflation, this account lets you invest your child's money in assets like stocks, bonds, and mutual funds. Over decades, this transforms even small, early contributions into a sum that could be truly life-changing.

To help you get a quick handle on this, here's a simple breakdown of the core features.

Custodial Roth IRA Key Features at a Glance

| Feature | Description |

|---|---|

| Account Owner | The minor child. The money legally belongs to them from day one. |

| Account Manager | The custodian (usually a parent or guardian) who makes all decisions. |

| Contribution Source | Must be from the child's earned income (e.g., jobs, gigs). |

| Tax on Growth | Completely tax-free when withdrawn in retirement. |

| Tax on Contributions | Contributions are made with after-tax dollars. |

| Control Transfer | The child gains full control of the account upon reaching legal adulthood. |

This table gives you the high-level view, but let's dig into the roles and rules that make it all work.

Understanding the Key Players

Every Custodial Roth IRA involves two main people, and it’s crucial to understand their roles.

- The Custodian: This is the adult—typically a parent, grandparent, or guardian—who opens and manages the account. You're in the driver's seat, responsible for choosing investments, making contributions, and handling all the administrative tasks until the child is legally an adult.

- The Beneficiary: This is the minor who actually owns the account and all the money in it. While the funds are theirs, they can't make any decisions until they come of age.

Think of it this way: you’re the captain of a ship, navigating it through the financial markets. Your child owns the ship and its valuable cargo, and they’ll take the helm once they're old enough to steer on their own.

Key Takeaway: The structure is brilliantly simple: You manage it, but your child owns it. This partnership allows you to make smart investment moves for them while they're still young.

How Contributions Fuel the Account

The engine of this wealth-building machine runs on one specific type of fuel: earned income. This is a non-negotiable rule. You can only contribute money that the child has legitimately earned from a job. This could be from a W-2 job like a summer lifeguard position or from self-employment gigs like babysitting, mowing lawns, or coding websites.

The IRS sets annual contribution limits. For 2025, for example, a child can contribute the lesser of their total earned income for the year or $7,000. So, if your teen earns $4,000 from a summer job, they can contribute up to $4,000. If they have a great year and earn $8,000, their contribution is capped at the $7,000 limit.

This framework gives your child a massive head start, turning even the smallest jobs into a foundation for future wealth. If you want to dive deeper, you can learn more about the specific rules for starting an IRA for your child.

The Unmatched Tax Advantages of Early Investing

Let’s get straight to the point: the single most powerful feature of a custodial Roth IRA is its incredible tax structure. You can think of it as a financial superpower that gives your child a huge head start by turning time into tax-free wealth.

When your child invests their hard-earned money, that cash can grow for decades without ever being taxed again. A few thousand dollars from a summer job, invested in their teens, can absolutely blossom into a life-changing sum by retirement. We're talking six or even seven figures, with every single dollar of growth being theirs to keep, free and clear from Uncle Sam.

The Brilliant Tax Trade-Off for Minors

The magic here lies in a very simple trade-off. Contributions to a Roth IRA are made with "after-tax" dollars. For a high-earning adult, this might cause a moment of hesitation. But for a minor? It's a brilliant move.

Most kids have very little income tax liability, if any at all. A teenager who earns $3,000 from a summer job will almost certainly pay zero federal income tax. This means their "after-tax" contributions are, in reality, essentially "pre-tax" because no tax was paid in the first place.

Key Insight: Your child gets the massive, long-term benefit of tax-free growth without the significant upfront tax hit that adults typically face. It's the ultimate financial hack for young earners.

This advantage really snaps into focus when you compare a custodial Roth IRA to a standard taxable brokerage account.

Custodial Roth IRA vs. Taxable Brokerage Account

| Feature | Custodial Roth IRA | Taxable Brokerage Account |

|---|---|---|

| Growth Taxation | 100% Tax-Free. All gains from dividends, interest, and asset sales grow completely tax-free inside the account. | Taxable. Dividends and interest are taxed every year. Capital gains are taxed whenever an asset is sold. |

| Withdrawal Taxation | Tax-Free. All qualified withdrawals in retirement are completely tax-free. | Taxable. You'll owe capital gains taxes on the growth portion of any money you take out. |

| Financial Impact | Preserves every single dollar of growth for your child. A $500,000 gain means a $500,000 withdrawal. | Taxes consistently chip away at the final amount. A $500,000 gain could easily result in a $75,000 tax bill. |

This isn't a small difference. Over a lifetime, it can mean saving tens, or even hundreds, of thousands of dollars. Every dollar that would have gone to the IRS in a brokerage account instead stays invested in the Roth, compounding and creating even more wealth for your child.

The real power comes from decades of this tax-free compounding. If a minor contributes $1,000 and that single investment grows to $1 million by retirement, they would owe zero taxes when withdrawing that money. You can discover more about how these tax rules create powerful outcomes and see just how impactful this can be.

The Ultimate Flexibility in Retirement

Beyond the incredible tax-free growth, the Roth IRA has another trick up its sleeve: no Required Minimum Distributions (RMDs) during the original owner's lifetime.

Unlike a traditional IRA or 401(k), which forces retirees to start taking money out at a certain age (currently 73), a Roth IRA has no such strings attached. This provides unparalleled flexibility.

- Let It Grow: If your child doesn't need the money, they can just leave it in the account to keep growing, completely tax-free, for their entire life.

- Tax-Free Inheritance: They can pass the account down to their own heirs, creating a significant, tax-advantaged financial legacy.

- Control Over Income: They get to decide when to take money out, avoiding forced distributions that could otherwise push them into a higher tax bracket in retirement.

This potent combination of tax-free growth and withdrawal flexibility is what makes the custodial Roth IRA such a special and powerful tool for building generational wealth.

Navigating Eligibility and Contribution Rules

Before your child can kick off their investing journey, we need to talk about the ground rules. The entire world of the custodial Roth IRA is built on a single, non-negotiable foundation: the child must have legitimate earned income.

This isn't just a suggestion; it's the absolute ticket to entry. Think of earned income as the fuel for this powerful financial engine. Without it, the account is stuck in park. This key rule ensures the account is used exactly as intended—to invest money the child has personally earned from actual work.

Figuring out what the IRS considers "earned income" is your first and most critical job. Getting this right is the difference between a compliant, high-growth account and a potential headache down the road.

The All-Important Earned Income Rule

The IRS is crystal clear about what counts as earned income. It has to be money your kid receives for work they actually performed. This is a crucial distinction, because it separates real work-based pay from other money a child might get, like gifts or an allowance.

For instance, a paycheck from a summer job lifeguarding or earnings from their own dog-walking business are slam dunks. The key, however, is that you must be able to prove this income if the IRS ever comes knocking.

So, what does this look like in the real world? Here are some straightforward examples:

- W-2 Employment: This is income from a formal job—think working at a local ice cream shop, a retail store, or as a camp counselor.

- Self-Employment/Gig Work: Money earned from side hustles like babysitting, mowing lawns, pet-sitting, tutoring, or even freelance coding totally counts.

- Family Business: You can pay your child fair wages for real work they do in your family business. This could be anything from filing papers and cleaning the office to managing your social media accounts.

It's just as vital to know what doesn't count as earned income. Gifts and allowances are out.

- Gifts: Money from grandma for a birthday or holiday is a gift, not income.

- Allowance: Regular payments for routine household chores generally don't qualify, as they aren't tied to a specific "job."

- Investment Gains: Profit from other investments isn't considered earned income for this purpose.

Critical Takeaway: Meticulous record-keeping is your best friend. For any self-employment income, keep a simple log showing the date of work, the service provided, who paid, and how much was earned. This documentation is your golden ticket for proving legitimate earned income.

Decoding the Contribution Limits

Once you've confirmed your child has earned income, the next piece of the puzzle is figuring out how much you can put in. The rules are pretty simple: you can contribute up to 100% of your child's earned income for the year, but you can't exceed the annual federal maximum.

This creates a quick two-part check for every contribution. For 2024, the maximum contribution for anyone under age 50 is $7,000. This limit is set by the federal government and applies to all Roth IRAs, not just custodial ones.

Let's see how this works with a couple of real-life scenarios:

- Scenario 1: Your teen earns $4,500 from their summer job. The absolute most you can contribute to their custodial Roth IRA for the year is $4,500.

- Scenario 2: Your child starts a killer dog-walking business and brings in $9,000. Since that's more than the annual limit, their contribution is capped at $7,000 for the year.

Now, what about those income limits you hear about for adults? You might know that high-earning adults can be blocked from contributing to a Roth IRA. The good news is that these income phase-outs are based on the contributor's income—which, in this case, is your child. Since it's incredibly rare for a minor to earn an income that high, it's almost never a concern for a custodial Roth IRA. To get a deeper dive into the specifics, you can explore the detailed Roth IRA rules for minors in our dedicated guide.

Ready to put all this knowledge into action? Opening a custodial Roth IRA is surprisingly simple—you can usually get it done online in less than an hour. A few straightforward steps are all it takes to set up an account that will benefit your child for decades.

The single most important decision you'll make is choosing the right financial institution. It’s easy to get overwhelmed by all the options out there, but your focus should be narrow: find a broker that offers custodial Roth IRAs with no account fees, no trading commissions, and a great selection of low-cost funds.

Choosing the Right Brokerage

The brokerage you pick sets the foundation for your child's entire investing journey. You're looking for a partner that makes things easy and cheap. Big names like Fidelity, Charles Schwab, and Vanguard are popular for a reason—they are built for long-term, low-cost investing and have well-established custodial accounts.

As you compare your options, keep these features at the top of your list:

- Zero Account Fees: You shouldn't have to pay a yearly fee just for having the account open. That's a needless drag on returns.

- No-Fee Trading: Look for brokers that let you buy and sell stocks and Exchange-Traded Funds (ETFs) without charging a commission on each trade.

- Low-Cost Index Funds and ETFs: The best game plan for a young investor is almost always the simplest. You need access to broad-market index funds with tiny expense ratios (think under 0.10%). This is critical for maximizing growth over the long haul.

My Two Cents: Don't get distracted by flashy trading platforms or complicated charting tools. For a custodial Roth IRA, simple is smart. Your best bet is a reputable, low-cost provider that supports a "set-it-and-forget-it" approach.

The Four Steps to Get Started

Once you've picked your brokerage, setting up the account is a breeze. It's usually broken down into four clear steps that you can do right from your couch.

1. Gather Your Documents

To make the application process seamless, get your paperwork in order first. You’ll need information for both yourself (the custodian) and your child (the beneficiary).

Grab these items:

- Your Social Security Number and date of birth.

- Your child's Social Security Number and date of birth.

- Your contact information (address, phone, email).

2. Complete the Online Application

Head over to your chosen brokerage's website and find the option to open a new account. Pay close attention and select "Custodial Roth IRA" or "Roth IRA for Minors." You'll then enter the information you just gathered, officially naming yourself as the custodian and your child as the account owner.

3. Link a Bank Account

Next, you'll need to connect a bank account to fund the Roth IRA. This is a standard, secure process where you’ll provide your bank's routing and account numbers. This linked account is how you'll make all future contributions. Many parents find it helpful to link a dedicated savings account they use just for their child's earnings.

4. Make the First Deposit and Invest

With the account set up and linked, you're ready to make the first contribution. Just remember, you can only contribute up to the amount your child has earned for the year, and it can't be more than the annual IRA limit.

After the money lands in the account comes the final—and most crucial—step: investing the funds. Cash sitting in the account won't grow. It needs to be put to work. For most people, a simple, diversified portfolio of low-cost index funds or ETFs is the perfect starting point. You can also explore more about how a minor can have a Roth IRA to really nail down these concepts.

How a Custodial Roth IRA Stacks Up Against Other Savings Options

When you start looking into saving for your child's future, it can feel like you've fallen into a bowl of alphabet soup: IRA, 529, UTMA, UGMA. It's a lot to take in. But figuring out the core differences between these tools is the key to building a smart financial game plan for your kid.

The custodial Roth IRA is a real standout because of its unique mix of retirement focus, tax magic, and surprising flexibility. It’s not just another savings account; it's a specialized vehicle built for long-term, tax-free growth. Let's put it side-by-side with the other popular kids on the block to see where it really shines.

Custodial Roth IRA vs. 529 Plan

The most frequent matchup is the Roth IRA against the 529 plan, and for good reason—they have completely different primary missions. A 529 plan is a powerhouse for education savings. Its main superpower is that money grows tax-deferred and can be pulled out completely tax-free for qualified education expenses, like college tuition and fees.

The catch? If that money isn't used for education, the earnings portion of a withdrawal gets hit with both income tax and a 10% penalty. That makes it a bit of a one-trick pony compared to the Roth IRA, where contributions can be withdrawn anytime, for any reason, with no taxes or penalties. The Roth gives you freedom; the 529 gives you a laser-focused tax break for school.

Custodial Roth IRA vs. UTMA/UGMA Accounts

Next up are UTMA/UGMA accounts (short for Uniform Transfers/Gifts to Minors Act). Think of these as all-purpose custodial investment accounts. The big plus is that the child doesn't need earned income to have one. Anyone can gift money into it (though large gifts can trigger gift tax rules), and the funds can be used for anything that benefits the child.

But there’s a major trade-off: taxes. UTMA/UGMA accounts have none of the tax-free growth mojo of a Roth IRA. Instead, investment gains are hit with the "kiddie tax," which means gains over a certain amount are taxed at the parents' higher income tax rate. Ouch. On top of that, these accounts can seriously hurt financial aid eligibility because the assets are considered the child's property and weighed heavily by aid formulas.

Key Takeaway: A custodial Roth IRA is a retirement account first and foremost. This status protects it from most financial aid calculations and delivers far better tax benefits. A UTMA/UGMA is a general fund that offers more immediate flexibility but comes with a tax headache and can torpedo college aid prospects.

Custodial Roth IRA vs. High-Yield Savings Accounts

And what about a good old-fashioned high-yield savings account? It's the simplest and safest option, hands down. It’s a secure spot to park cash and earn a modest, guaranteed return. There’s no investment risk, and the money is always there when you need it.

The downside is painfully slow growth. Even the best high-yield savings accounts struggle to keep up with inflation over the long haul, let alone the stock market. This means the money’s actual buying power can shrink over time. A custodial Roth IRA, which can be invested in stocks and other assets, offers a much, much higher ceiling for growth over the decades.

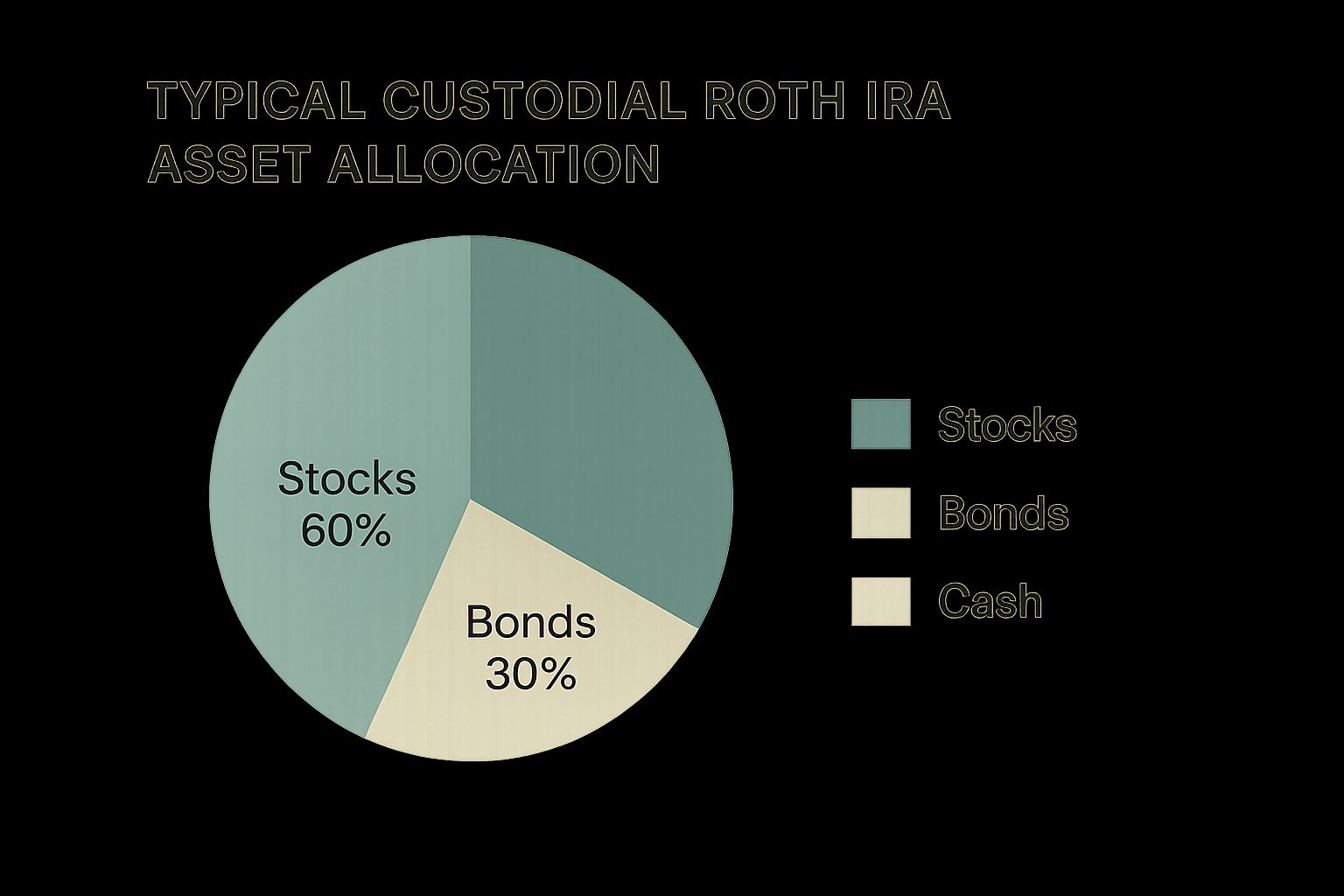

Here’s a look at how you might invest the money inside a custodial Roth IRA to really get it working for your child's future.

This kind of growth-focused mix, heavy on stocks, is designed to maximize returns over a long time horizon, with bonds and cash providing a bit of a cushion.

To pull all this together, let’s look at a direct comparison.

Custodial Roth IRA vs. 529 Plan vs. UTMA/UGMA Account

Deciding between these accounts really comes down to what you're trying to achieve for your child. Are you saving for retirement, education, or just general life expenses? The table below breaks down the key differences to help you see which tool is the right one for the job.

| Feature | Custodial Roth IRA | 529 Plan | UTMA/UGMA Account |

|---|---|---|---|

| Primary Purpose | Retirement Savings | Education Savings | General Savings/Gifting |

| Contribution Source | Must be child's earned income | Anyone can contribute | Anyone can contribute |

| Tax on Growth | Tax-Free | Tax-Deferred | Taxable ("Kiddie Tax") |

| Tax on Withdrawals | Tax-Free (qualified) | Tax-Free (for education) | Taxable (on gains) |

| Financial Aid Impact | Not reported on FAFSA | Reported, but favorable | Reported, very unfavorable |

| Flexibility | High (contributions withdrawable anytime) | Low (penalties for non-education use) | High (but child gets full control at 18/21) |

As you can see, there's no single "best" account—only the best account for a specific goal. The custodial Roth IRA's unique blend of tax-free growth, withdrawal flexibility, and minimal impact on financial aid makes it an incredibly powerful and versatile tool in your child's financial toolkit.

A custodial Roth IRA is so much more than a place to stash your kid’s summer job money. It’s one of the best financial teaching tools you can possibly give them. It takes fuzzy concepts like "saving for the future" and makes them real, tangible, and honestly, a little exciting.

Think about it. This account creates a direct, visible line between the hard work they do today and the financial security they can build for tomorrow. Instead of just lecturing them about saving, you get to show them.

From Paycheck to Portfolio

The magic really starts when you make the whole process interactive. Don't just transfer the money behind the scenes. Sit down with your child and pull up their pay stubs or the spreadsheet you helped them build for their lawn-mowing business.

Then, open up the brokerage account statement together. Point to the fresh deposit and say something like, "See this? This is the money you earned. Now, let's put it to work." That simple act connects the dots between labor and investing—a lesson many adults never truly learn.

When you actively involve your child, the custodial Roth IRA becomes their account, not just some fund you manage for them. It shifts from a boring, passive investment into an engaging, hands-on project that builds real financial confidence.

This process also gives them a huge sense of ownership and pride. This isn't gift money. It’s not an allowance. It's money they earned with their own two hands. That connection is absolutely crucial for building a healthy, lifelong relationship with money.

Explaining the "Magic" of Compounding

Compound interest can feel like a tough concept to explain, but a custodial Roth IRA gives you a live-action demonstration.

You can show them how their initial investment grows, even by a few dollars. Explain that the money their money earned is now starting to earn its own money. I like using the analogy of a snowball rolling downhill—it gets bigger and bigger all on its own, without any extra pushing from you.

To really drive the point home, try these tricks:

- Fire Up a Calculator: Use an online compound interest calculator. Plug in their current balance, a reasonable estimated growth rate, and show them what that could look like in 10, 20, or even 50 years. The numbers can be mind-boggling.

- Visualize the Goal: Help them picture what that future money actually means. Maybe it’s a down payment on their first home or just the freedom to choose a career they love without worrying about money.

- Review Statements Together: Make it a quarterly tradition to look at the account's performance. Celebrate the wins. And when the market is down? It’s the perfect teaching moment about long-term thinking and why you don't panic sell.

Practical Tips for the Custodian (That's You!)

As the custodian, your job is part manager, part guide. You’re not just moving money around; you’re teaching the powerful habits of consistency and discipline.

Here are a few tips to make the most of your role:

- Automate It: Set up automatic transfers from the bank account where their earnings land. This is the ultimate "pay yourself first" lesson.

- Keep Good Records: A simple spreadsheet tracking every dollar they earn is invaluable. It reinforces the importance of being organized and staying compliant with the rules.

- Offer a "Parent Match": This is a fantastic way to supercharge their savings and introduce another core financial concept. Consider matching their contributions, say 50 cents or a dollar for every dollar they put in. It's a preview of how a 401(k) match works at a future job.

By taking these steps, you turn a simple retirement account into a multi-year masterclass in financial responsibility, patience, and the incredible rewards of a good work ethic.

Frequently Asked Questions About Custodial Roth IRAs

Even when you've grasped the big picture, the nitty-gritty details of a custodial Roth IRA can bring up more questions. Let's tackle some of the most common ones that come up for parents, so you can move forward with total clarity.

What Really Counts as Earned Income for a Minor?

This is the most important rule to get right, and it's simpler than you might think. Earned income is just money your child gets for doing actual work. It’s a paycheck for a real service, not a gift or a handout.

Think of things like:

- A W-2 from a classic summer job, like scooping ice cream or being a camp counselor.

- Documented pay from their own side hustle—babysitting, mowing lawns, designing logos, you name it.

For any self-employment or gig work, good record-keeping is your best friend. A simple spreadsheet tracking who paid them, for what service, on what date, and for how much is perfect.

What definitely does not count as earned income?

- Gifts: Birthday money from Grandma or cash for good grades are wonderful, but they aren't earned income.

- Allowance: Money for routine household chores you'd expect them to do anyway generally doesn't qualify.

- Investment Gains: Profits from stocks or other investments don't count for this purpose.

Key Reminder: The pay has to be reasonable for the job. You can't just pay your eight-year-old $500 to take out the trash once and call it a day. The IRS expects the payment to make sense for the work performed.

How Does My Child Take Control of the Account?

The handover of control is a built-in, automatic feature of the account. That's what the "custodial" part is all about—you manage the account for your child until they legally become an adult.

This age of majority is set by your state, but it's usually 18 or 21.

Once your child hits that milestone, the account is theirs, free and clear. You'll simply work with your brokerage to transfer full ownership to them. From that point on, they call the shots on all investment decisions and future contributions. It's a seamless transition designed to empower them as young adults.

Can We Use the Money for College Without Penalties?

Yes, and this is one of the account's most powerful features. A custodial Roth IRA can be a fantastic, flexible partner to a dedicated college fund like a 529 plan. The IRS rules allow for penalty-free withdrawals for qualified higher education expenses, like tuition and fees.

Here’s the breakdown:

- Contributions Come Out First: Your child can pull out every dollar they originally contributed at any time, for any reason (college included), completely tax-free and penalty-free. No questions asked.

- Earnings Can Follow: After all contributions are withdrawn, they can start tapping into the investment earnings to pay for college. While they will owe regular income tax on these earnings, they'll avoid the steep 10% early withdrawal penalty.

This dual-purpose potential adds an incredible layer of flexibility. While the main goal is a rich retirement, knowing the funds can pivot to cover a huge expense like college provides some serious peace of mind.

Ready to give your child a decades-long head start on building wealth? At RothIRA.kids, we demystify the process with our free starter guide, income-earning ideas for kids, and easy-to-use calculators. Visit us today to learn how to turn your child's first paychecks into a powerful, tax-free financial future at https://rothira.kids.