Absolutely. But there’s a catch, and it’s a big one: they must have earned income. This isn’t just a suggestion; it’s the non-negotiable ticket to entry. If your kid is mowing lawns, babysitting, or pulling shifts at a summer job, they’ve officially cleared the biggest hurdle.

The Ultimate Head Start in Financial Planning

Opening a Roth IRA for your child is like giving them a cheat code for building wealth. You’re essentially planting a financial sequoia tree for them while most of their peers haven’t even thought about buying seeds. It gives them a multi-decade head start, letting them tap into the incredible power of compound growth in a completely tax-free account.

So, how does this work in practice? Since a minor can’t legally open an investment account on their own, it has to be set up as a custodial Roth IRA.

Think of it this way: you, as the parent or guardian, are the custodian. You open the account and manage it on their behalf, making the investment decisions until they reach the age of majority in your state (which is usually 18 or 21). Once they hit that age, the keys are handed over, and the account becomes theirs entirely.

Understanding the Contribution Rules

Here’s the most important rule to remember: contributions are limited to the child’s earned income for the year, up to the annual maximum.

For 2024 and 2025, the IRS limit is $7,000 for anyone under 50. But if your teenager only earned $2,500 from their part-time job, then $2,500 is the absolute most that can be put into their Roth IRA for the year. This rule is brilliant because it forges a direct link between the value of work and the reward of long-term investing. For more on the official guidelines, you can always check the IRS contribution limits directly.

A custodial Roth IRA does more than just build wealth. It teaches a fundamental principle: money is a tool that grows when you put it to work. It transforms the abstract idea of “saving for the future” into a tangible, growing asset they can actually see.

To help you get a clear picture of how this works, here’s a quick rundown of the key details.

Custodial Roth IRA At a Glance

| Requirement/Benefit | Explanation |

|---|---|

| Earned Income | The child must have income from a job or self-employment (e.g., babysitting, freelance work). |

| Contribution Limit | Contributions cannot exceed their earned income for the year, up to the annual IRS limit ($7,000 in 2024/2025). |

| Custodian Role | An adult (usually a parent) opens and manages the account until the child reaches legal age (18 or 21). |

| Tax-Free Growth | All investment gains grow completely tax-free. |

| Tax-Free Withdrawals | Qualified withdrawals in retirement are 100% tax-free. |

| Flexibility | Contributions can be withdrawn at any time, for any reason, without taxes or penalties. |

This structure makes it a powerful and educational tool, blending parental guidance with real-world financial experience for the child.

Why This Is Such a Powerful Strategy

It’s genuinely hard to overstate the benefits of starting this early. We’re not just talking about the final account balance; it’s about the financial DNA you’re helping to build.

- The Magic of Time: Even a small amount invested in the teen years can snowball into a life-changing sum by retirement. It’s the longest possible runway for compound interest to work its magic.

- A Truly Tax-Free Nest Egg: All the growth—every single dollar of it—is completely tax-free when they take it out in retirement. This is a massive advantage over other types of accounts.

- Building Habits That Stick: It directly connects the effort of working with the reward of investing. That’s a lesson that pays dividends for a lifetime.

What Counts as Earned Income for a Child?

This is the single most important rule to get right, so let’s be crystal clear: a minor absolutely must have earned income to be eligible for a Roth IRA. This is the non-negotiable foundation of the whole strategy.

Put simply, your child needs to get paid for actual work they’ve done, and you need a way to prove it. The IRS is quite specific about what counts, so getting this right from the start is crucial.

Green-Light Income Sources

So, what kind of work qualifies? The easiest, most straightforward proof is a W-2 form from a traditional job. If your teen works at the local grocery store, movie theater, or ice cream shop, you’re golden. A W-2 is the gold standard for proving earned income.

But what about all the side hustles kids do these days? Good news: that money absolutely counts, too. From babysitting to building websites, self-employment income is perfectly legitimate. The key is that they’re being paid by someone for a real service.

Common examples of qualifying work include:

- Babysitting or pet-sitting for neighbors

- Lawn care like mowing, raking leaves, or shoveling snow

- Tutoring younger kids

- Running a small business, like selling handmade crafts or running a summer car wash

- Freelance gigs, like simple graphic design or managing social media for a local business

For these kinds of jobs, good records are your best friend.

Red-Light Money That Does Not Qualify

It’s just as important to know what the IRS does not consider earned income. This is where parents can easily make a mistake without realizing it. Any money your child receives that isn’t a direct payment for their labor is off-limits for Roth IRA contributions.

Crucial Takeaway: Earned income is money paid for work. Gifts, allowance for basic chores, and investment gains do not qualify for funding a Roth IRA.

Here are the most common sources of money that are explicitly excluded:

- Allowance: Money you give your child for routine household chores (like making their bed or tidying their room) generally doesn’t count.

- Gifts: Cash from a grandparent or for a birthday is a gift, not income.

- Investment Returns: Dividends, interest, or profits from other investments are considered investment income, not earned income.

The Importance of Good Record-Keeping

If your child is earning money from side hustles, you have to track it. Don’t let this part intimidate you—it doesn’t need to be fancy. A simple notebook or a basic spreadsheet is all you need to create a clean paper trail.

For every job your child completes, just log these four things:

- The date the work was done.

- What they did (e.g., “Mowed the lawn for Mr. Smith”).

- How much they were paid.

- Who paid them.

This simple ledger proves the income is real and tied to actual work. This documentation is your backup if the IRS ever asks questions, giving you total peace of mind that you’re setting up this incredible financial tool for your child the right way.

How to Open a Custodial Roth IRA Account

Alright, you’ve got the scoop on the earned income requirement. Now it’s time for the fun part: putting it all into action.

Opening a custodial Roth IRA is surprisingly straightforward. The key thing to remember is that it requires an adult—the custodian—to open and manage the account until your child is legally an adult in your state. This is usually age 18 or 21.

As the custodian, you’ll be the one picking the brokerage, choosing the investments, and making sure contributions line up with their earnings. Think of yourself as the account’s guardian, steering the ship responsibly until you hand the wheel over to your child. It’s a fantastic way to give them your guidance during their early financial years.

Choosing the Right Brokerage

Your first move is to pick a financial institution. Not every brokerage out there offers custodial Roth IRAs, so you’ll want to focus on the ones that do. The best ones typically have low (or no) fees, a solid menu of investment choices like index funds, and a platform that’s easy to navigate.

Three of the most popular and trusted names in the game are:

- Fidelity: A fan favorite, known for its $0 account fees and no minimum deposit to get started.

- Charles Schwab: Offers a huge variety of investment products and has a reputation for great customer support.

- Vanguard: Famous for its low-cost index funds and ETFs, which are perfect for a long-term, set-it-and-forget-it growth strategy.

Once you’ve picked a brokerage, the online application is usually quick and painless. You’ll just need to plug in some basic information for both you and the minor.

It’s crucial to remember this: the account legally belongs to your child. You’re just the manager. Every single dollar you put in has to be justified by your child’s earned income, cementing that powerful link between their hard work and their growing wealth.

To get the account open, you’ll typically need your child’s Social Security number and birthdate, along with your own details. This is just a standard identity verification step for both the minor and the custodian. If you want to take a deeper dive into the nitty-gritty, you can learn more about the complete Roth IRA for minors rules and how they apply.

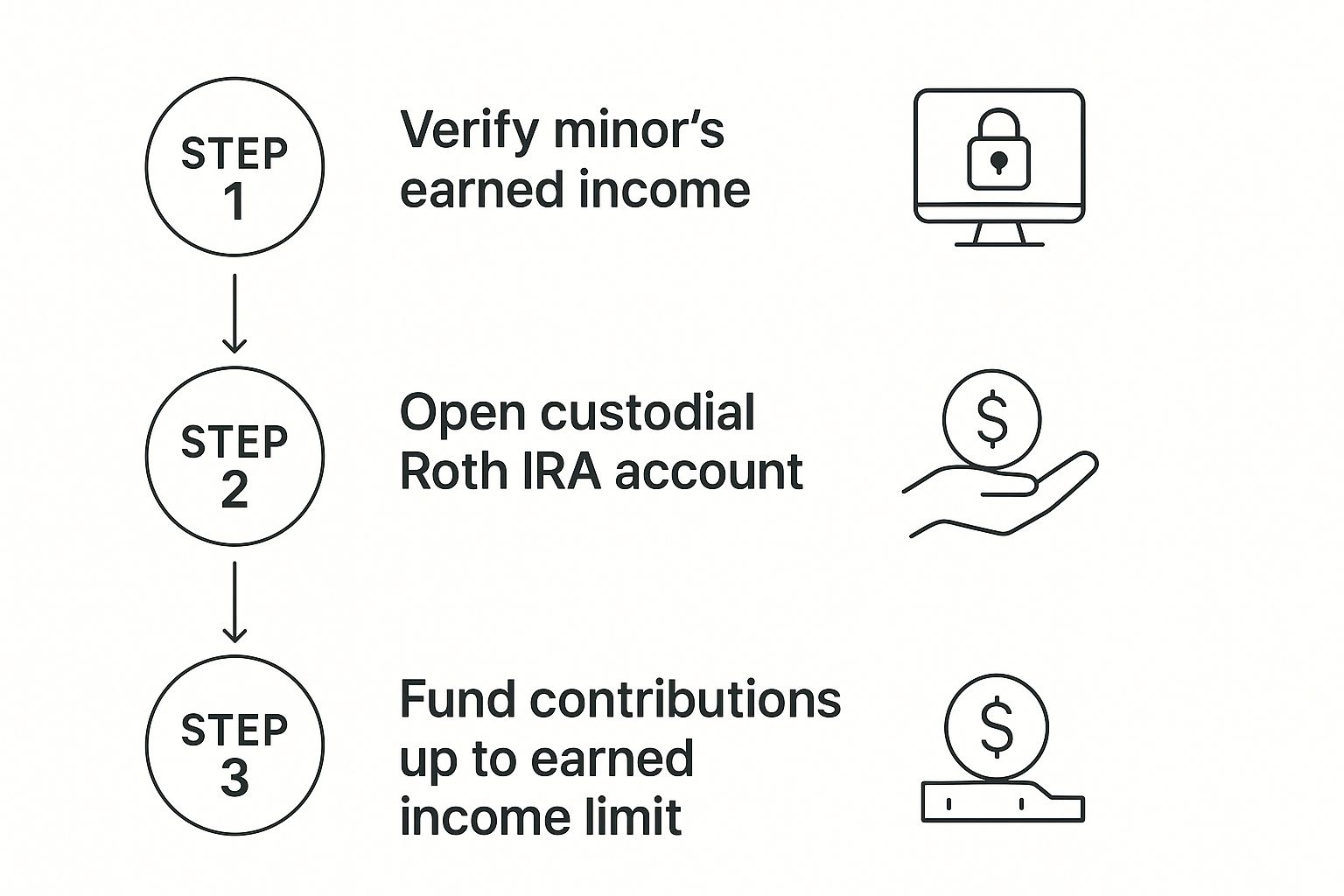

The infographic below shows the simple, three-step journey from earning to investing.

This flow really drives home the main point: earned income is the key that unlocks the door to opening and funding the account.

Funding the Account Correctly

Once the account is open, the last step is to add money. This is where that earned income rule becomes absolutely critical.

Every dollar contributed has to be backed by a dollar your child actually earned. So, if your teen pulls in $3,000 from a summer lifeguarding job, you can contribute up to $3,000 for that year.

Here’s a cool part: as the parent, you can gift them the cash for the contribution. But the amount can never go over what they’ve verifiably earned. This creates a powerful, tangible lesson for them, showing exactly how their hard work translates into real, long-term wealth.

Smart Investment Choices for a Young Investor

Getting a custodial Roth IRA opened is the first big win. You’ve officially secured the perfect container to grow your child’s wealth for decades to come. But now comes the question that trips a lot of people up: what do you actually buy inside the account?

It’s a crucial point to understand. The Roth IRA isn’t the investment itself—it’s just the tax-advantaged bucket that holds the investments.

Think of it like a top-of-the-line garden plot. The plot (your Roth IRA) gives you fertile soil and protects your plants from pests and bad weather. But a great plot is useless if you don’t plant anything. You still have to choose the seeds (the investments) that will grow into something amazing.

With a time horizon of 50+ years, the game isn’t about trying to time the market or pick the next hot stock. The real goal is to plant a few high-quality, diverse seeds and then have the patience to let them grow.

Keep It Simple with Set-It-and-Forget-It Options

For a young investor, complexity is the absolute enemy. The best strategy is almost always the simplest one. This isn’t the time to play stock-picking genius. Instead, the smart move is to lean on proven, low-maintenance investments built for the long haul.

For a child’s Roth IRA, two options stand head and shoulders above the rest:

- Broad-Market Index Funds: Imagine buying a tiny piece of the entire U.S. stock market—like the S&P 500—all in one go. That’s an index fund. It gives you instant diversification, comes with rock-bottom fees, and historically delivers solid returns simply by matching the market’s own growth.

- Target-Date Funds: This is the ultimate “set it and forget it” choice. You just pick a fund with a retirement year way out in the future (say, a 2070 fund). From there, the fund does all the work, automatically shifting from an aggressive growth strategy to a more conservative one as your child gets closer to retirement.

The whole point here is to let the magic of compounding do the heavy lifting. By choosing a simple, diversified, low-cost fund, you’re building a powerful engine for tax-free growth that can hum along for decades without needing you to constantly tinker under the hood.

The Power of a Long-Term Perspective

When your child has decades before they’ll even think about retirement, they possess an investor’s greatest superpower: time. They have the runway to easily weather the market’s inevitable ups and downs without breaking a sweat. Short-term volatility just doesn’t matter.

This incredibly long timeframe is a green light to embrace a growth-focused strategy. When you invest in the broad market, you’re making a bet on the long-term health and ingenuity of the economy as a whole. History has shown that to be one of the most reliable bets you can make.

So, fight the urge to overmanage the account. Plant the seeds, water them with steady contributions when you can, and give them the one thing they need most: time to grow into a massive, tax-free financial tree.

The Extraordinary Power of Starting Early

This is where the real magic of a custodial Roth IRA comes to life. Getting the rules down is one thing, but actually seeing the incredible power of compound interest play out over decades is something else entirely. It’s the closest thing to a financial superpower your child will ever have.

Let’s make this real with a quick story about two young savers, Sarah and Leo.

- Savvy Sarah: At age 15, she starts putting $2,000 a year from her summer job into a Roth IRA. She does this every year until she’s 21, then stops contributing forever. Her total investment? Just $14,000.

- Late-Start Leo: He doesn’t start investing until he’s 25. But he’s diligent, putting away $2,000 every single year for 40 years straight, right up until he retires at 65. His total investment is a whopping $80,000.

So, who do you think ends up with more cash for retirement?

It might surprise you, but it’s Sarah. Even though she invested nearly six times less money, her final account balance would likely be hundreds of thousands of dollars larger than Leo’s.

The Unstoppable Force of Compounding

How is that possible? It’s not a trick. It’s the simple, beautiful math of compound growth.

The money Sarah invested in her teens had a full decade head start on Leo’s. That’s ten extra years for her investments to work for her, with each year’s earnings generating their own earnings. This creates a financial snowball that starts small but grows exponentially over time, eventually becoming an unstoppable force.

The numbers back this up. A kid who starts putting $3,000 a year into an account earning an average annual return of 7% could have over $1 million by the time they hit 65. You can dig into more scenarios and see the potential of Roth IRA contributions on Schwab’s website.

Contribution Limits Keep Going Up

One of the great things about IRAs is that the government periodically increases how much you can contribute. This gives young savers even more firepower over time. Just look at how the limits have grown over the past couple of decades.

Contribution Limits History Roth IRA

This table shows how Roth IRA contribution limits for individuals under 50 have increased over time, highlighting the growing opportunity for savings.

| Year(s) | Annual Contribution Limit |

|---|---|

| 2002–2004 | $3,000 |

| 2005–2007 | $4,000 |

| 2008–2012 | $5,000 |

| 2013–2018 | $5,500 |

| 2019–2022 | $6,000 |

| 2023 | $6,500 |

| 2024 | $7,000 |

As you can see, the ability to save in a tax-advantaged way has more than doubled. This trend means today’s kids have an even greater opportunity to build wealth than the generations before them.

The Roth IRA’s Tax-Free Superpower

On top of this jaw-dropping growth, the Roth IRA has another game-changing feature: all that growth is completely tax-free in retirement.

When Leo finally cashes out his investments, he’ll have to hand over a hefty chunk of his earnings to the IRS. But when Sarah withdraws her much larger nest egg, every single penny—including all the massive growth over 50 years—is hers to keep. 100% tax-free.

This one-two punch of decades-long compounding and tax-free withdrawals is what makes the custodial Roth IRA one of the most powerful wealth-building tools ever created. You’re not just helping your child save some money; you’re giving their earliest paychecks the best possible environment to grow for a lifetime.

Got Questions? Let’s Find Some Answers.

Even after you’ve got a handle on the basics, a few questions always pop up. That’s a good thing—it means you’re thinking through the details. Let’s walk through some of the most common ones so you can move forward with total confidence.

Can I Just Give My Child the Money to Contribute?

Absolutely, and it’s one of the best ways to do it. Parents often ask if the money has to come straight out of their kid’s own bank account, and the answer is a firm no. You are completely free to gift your child the funds for their Roth IRA contribution.

The one golden rule still applies: the total contribution can’t be more than your child’s earned income for the year.

Think of it this way: if your daughter earns $1,500 working at a summer camp, she’s free to spend that money on movie tickets, new shoes, or whatever she likes. You can then turn around and gift her $1,500 to put directly into her Roth IRA. She gets to enjoy the immediate rewards of her hard work, while you help her build a foundation for her future.

This turns into a brilliant teaching moment. You’re essentially creating a “parent match,” showing your child that you’re so committed to their future that you’ll match their work ethic with your own investment in their success.

This strategy is 100% within IRS guidelines and is how many families make the most of this powerful account.

What Happens When My Child Becomes an Adult?

This is one of the easiest parts of the whole deal. Once your child reaches the age of majority in your state (which is usually 18 or 21), the “custodial” label simply dissolves. The account automatically becomes a standard, individual Roth IRA, and your child takes full control.

Your role as the custodian officially ends. The keys to the financial kingdom are now in their hands. This is a huge milestone, so it’s a great idea to have a conversation about the responsibility that comes with managing a growing investment account before the handover happens.

Can My Child Use the Money Before Retirement?

One of the standout features of a Roth IRA is just how flexible it is. It’s built for retirement, but it’s not locked down like a 401(k). This makes it a fantastic, multi-purpose tool for a young saver.

Here’s how it works:

- Contributions Are Always Available: Your child can pull out their direct contributions—the actual dollars they put in—at any time, for any reason, without paying a dime in taxes or penalties. If they’ve put in $5,000 over the years, they can take that $5,000 right back out.

- Earnings Have Stricter Rules: Dipping into the investment earnings before age 59½ usually means paying income tax plus a 10% penalty. But there are some important exceptions, like using up to $10,000 in earnings for a first-time home purchase.

This flexibility creates a nice safety net while still keeping the focus on long-term growth.

How Does a Roth IRA Affect College Financial Aid?

This is a big one for parents juggling college savings and retirement goals. The good news is that custodial Roth IRAs get very favorable treatment when it comes to financial aid. On the Free Application for Federal Student Aid (FAFSA), retirement assets in the student’s name are not reported.

That means the balance in your child’s Roth IRA generally won’t hurt their chances of qualifying for need-based financial aid. This gives it a massive leg up on other custodial accounts (like UTMAs/UGMAs), which are considered student assets and can dramatically reduce an aid offer. For a deeper dive into how these accounts fit into the bigger picture, check out our complete Roth IRA for Kids 101 guide.

At RothIRA.kids, our mission is to empower you with the knowledge and tools to give your children a monumental head start on their financial journey. We provide simple, actionable guidance to help you navigate the process of setting up and funding a Roth IRA for your child, turning their earliest paychecks into a foundation for generational wealth. Discover how to get started at https://rothira.kids.