What if you could give your child a multi-decade head start on building their retirement wealth? That’s exactly what a custodial Roth IRA does. Think of it as a supercharged investment account where your child’s money can grow for years and years, completely tax-free.

The basic rules from the IRS are straightforward: your child needs to have legitimate earned income, and an adult (that’s you!) has to open and manage the account for them.

Giving Your Child a Head Start on Financial Freedom

A custodial Roth IRA is genuinely one of the most powerful financial gifts you can give. It’s like planting a tiny sapling that, thanks to decades of compounding and a powerful tax shield, grows into a mighty financial tree. Even though the annual contribution amounts might seem small, the long-term potential is staggering.

Beyond the numbers, this account helps you lay the groundwork for a secure financial future by teaching crucial money lessons early on. (If you want a full breakdown of the basics, our Roth IRA for Kids 101 guide is a great place to start).

Here’s a quick look at why it’s such a game-changer:

- Tax-Free Growth: This is the big one. Every dollar the investments earn grows completely tax-free and can eventually be pulled out in retirement without ever sending a dime to the IRS.

- Surprising Flexibility: The money your child contributes can be withdrawn tax-free and penalty-free, anytime, for any reason. It’s a great safety net.

- Real-World Financial Education: Nothing teaches kids about saving, investing, and even entrepreneurship like having some real skin in the game. This account makes those lessons tangible.

The Earned Income Rule: A Non-Negotiable Requirement

Let’s get straight to the point. The single most important rule for a kid’s Roth IRA is this: they must have earned income. This isn’t just a suggestion—it’s a hard-and-fast regulation from the IRS.

This means birthday money from grandma, cash gifts, or an allowance for doing chores around the house simply won’t cut it. The money has to come from real work.

What Counts as Earned Income?

So, what kind of work gets the green light from the IRS? You might be surprised by the flexibility here. It covers both traditional jobs and the classic kid side-hustle.

Common examples that count include:

- A “Real” Job: Paychecks from a summer gig bagging groceries or working at a local ice cream shop (anything that generates a W-2).

- Self-Employment: Money they make from babysitting, mowing lawns, walking dogs, or tutoring younger kids.

- Working for the Family Business: As long as it’s a legitimate job with reasonable pay for the work performed, this absolutely qualifies.

The core principle is simple: a child can’t contribute more to their Roth IRA than they actually earned in a given year. It ensures the account is funded by their own labor, not by financial gifts.

Think of it this way: if your teenager pulls in $3,000 from their summer job, that’s the absolute most you can contribute to their Roth IRA for the year. It doesn’t matter if the official IRS contribution limit is higher. Their earnings create their personal contribution ceiling. You can explore the benefits of starting an IRA for your child to see how powerful this can be over time.

How Much Can My Kid Actually Contribute?

Once your child is officially on the payroll somewhere—even if it’s just your own small business—you’ve cleared the first hurdle. The next question is always, “So, how much money can we put in?”

The rule here is simple, but it’s one of the most important Roth IRA for minors rules to remember. The amount you can contribute is capped by one of two things, whichever is smaller:

- The child’s total earned income for the year.

- The annual IRS contribution limit for that year.

Let’s say the IRS limit is $7,000. If your teenager hauls in $4,000 from a summer lifeguarding gig, then $4,000 is their personal contribution ceiling for the year. You can’t put in a penny more. It’s a direct link: no earnings, no contributions.

Who Can Fund the Account?

Here’s a common misconception I see all the time: many parents think the child has to use the actual dollars they earned from their job to fund the IRA. Thankfully, it’s more flexible than that.

Anyone—you, a grandparent, a generous aunt—can give money to fund the child’s Roth IRA.

The IRS doesn’t care whose bank account the money comes from. All they care about is that the total amount deposited into the Roth IRA for the year doesn’t exceed what the minor legitimately earned that same year.

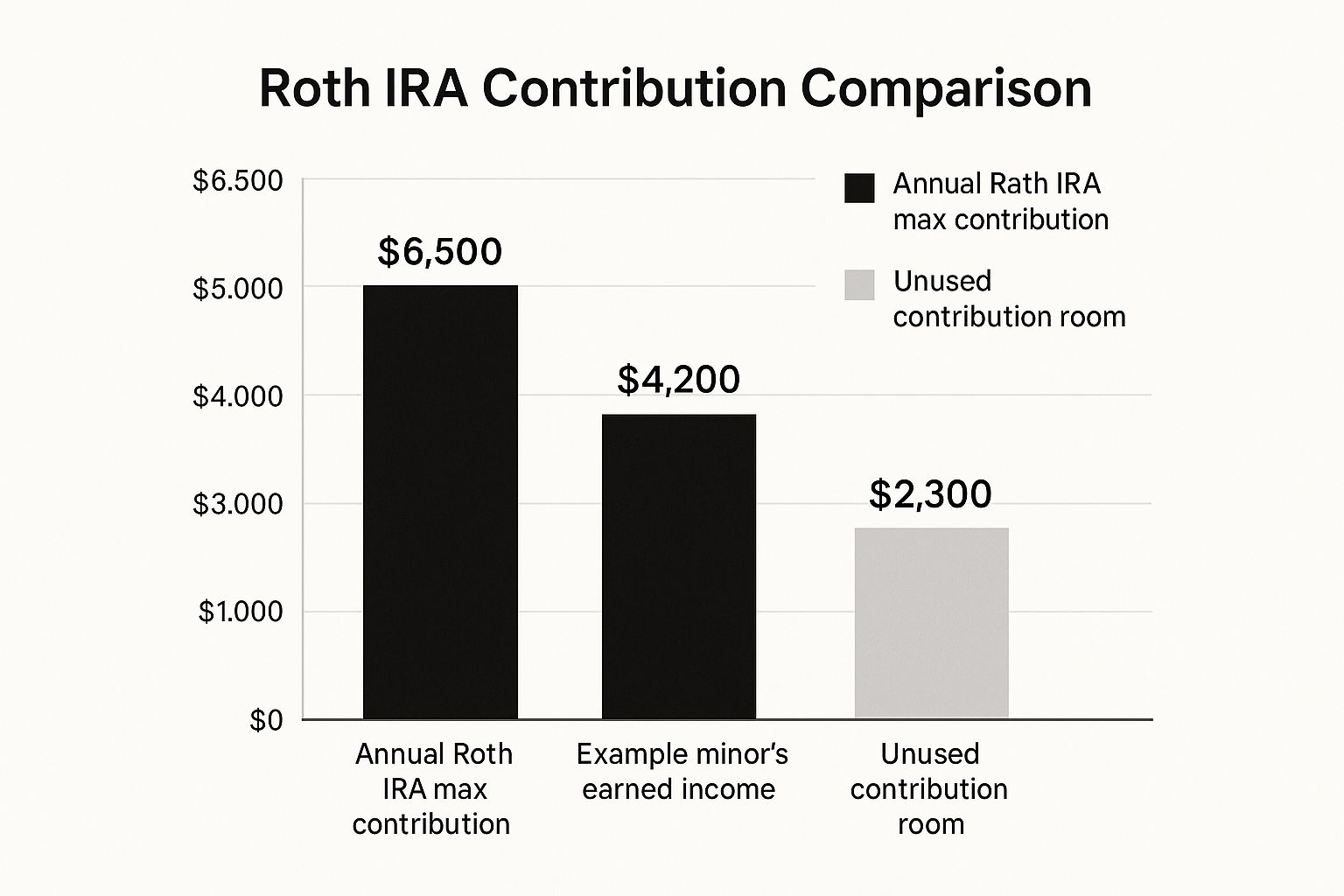

This bar chart gives you a quick visual of how this works. The child’s earned income is the ultimate gatekeeper for their contributions.

As you can see, even if the official IRS limit is high, it’s the child’s real-world earnings that set their personal cap.

To bring this to life, let’s look at a few common scenarios. This table shows exactly how the earned income rule plays out.

Roth IRA Contribution Scenarios for a Minor

| Minor’s Annual Earned Income | IRS Annual Limit | Maximum Allowed Contribution |

|---|---|---|

| $2,500 (Babysitting) | $7,000 | $2,500 |

| $7,000 (Summer Internship) | $7,000 | $7,000 |

| $9,000 (Part-time Job) | $7,000 | $7,000 |

The takeaway is clear: the contribution is always the lower of the two numbers. Once their income surpasses the IRS limit, the annual limit becomes the new ceiling.

The IRS does adjust the maximum contribution amount from time to time to account for inflation. For 2024, that limit is $7,000 for anyone under 50. It’s always a good idea to check the latest contribution limits on Schwab.com to make sure you have the most current information.

Want to see how your child’s specific numbers stack up? Plug their earnings into our simple Roth IRA calculator to find their exact maximum contribution.

Here’s the rewritten section, designed to sound like an experienced human expert:

The Custodian’s Role in Managing the Account

Because kids can’t legally open their own brokerage accounts, an adult has to step in and run the show. This person is called the custodian, and they’re usually a parent or legal guardian.

Think of the custodian as the account’s temporary manager. They’re in charge of everything from opening the account to picking the investments and making sure all the Roth IRA for minors rules are followed. Basically, the adult is the steward, handling all the financial moves on the child’s behalf.

This arrangement is what’s known as a custodial Roth IRA. The adult oversees the account until the child hits the “age of majority” in their state, which is usually 18 or 21. If you want to dive deeper, you can check out some great insights on custodial accounts at Schwab.com.

The custodian’s most critical job isn’t just managing the money—it’s preparing for the day they hand over control. This legal transfer is more than a signature on a form; it’s the perfect moment to teach your child about financial ownership and responsibility.

Getting Money Out: The Rules for Minors’ Roth IRAs

One of the best things about a Roth IRA is just how flexible it is, especially when it comes to getting money out. But it’s not a free-for-all. You have to understand that there are two different kinds of money inside the account: the original contributions and the investment earnings. The IRS treats them very differently.

Think of the contributions—the actual cash put into the account—as the most accessible part. The custodian can pull this money out for the minor’s benefit whenever they need to, for any reason at all, and it’s completely tax-free and penalty-free.

This is a huge deal. It makes the Roth IRA a surprisingly powerful tool that doubles as an emergency fund. If a big, unexpected cost pops up, you can tap into the original contributions without getting hit with a tax bill.

The Rules for Withdrawing Earnings

Now, the investment earnings are a different story. These are the profits the account has generated over the years. If you try to pull out those earnings before the account owner turns 59½, you’ll generally face a double whammy: ordinary income taxes on the amount withdrawn plus a 10% early withdrawal penalty.

But even here, the IRS cuts you a little slack. There are some key exceptions to that penalty, like using the money for a first-time home purchase or to cover qualified higher education expenses. Knowing the difference between contributions and earnings is what separates savvy investors from those who make costly mistakes.

Your Top Questions Answered

When you start digging into the details of a Roth IRA for a minor, a few common questions always seem to pop up. Let’s tackle them head-on so you can move forward confidently and sidestep any common mix-ups.

How Do I Prove Income From a Babysitting Gig?

This is a classic “cash job” problem, but the IRS has a clear answer. If your child is self-employed—think babysitting, mowing lawns, or delivering papers—the key is to keep meticulous records. It doesn’t have to be fancy. A simple log showing the date, who paid them, what they did, and how much they earned is perfect.

To create an even stronger paper trail, have your child deposit that cash into their own bank account. If they earn $400 or more in a year from this kind of work, they’ll need to file a tax return. While that might sound like a hassle, that tax return becomes the ultimate, official proof of their earned income.

Will This Account Affect College Financial Aid?

Here’s some great news. A custodial Roth IRA is not considered a reportable asset on the FAFSA (Free Application for Federal Student Aid). That’s a huge plus.

But there’s a catch to be aware of. While the account itself doesn’t hurt you, any money withdrawn from it counts as the student’s income for that year. A spike in income can unfortunately lower their eligibility for need-based financial aid in the following school year, so it’s a factor to plan around carefully.