Investing isn't just for grown-ups. The fundamentals are simple: you're making your money work for you. And when it comes to investing, time is the single greatest asset anyone can have. For a child, that asset is practically unlimited.

This guide will show you how to give your child a financial head start that could genuinely change their life.

Why Investing Is Your Child's Greatest Advantage

Forget about the intimidating charts and Wall Street jargon for a minute. Think of investing like this: you're planting a tiny seed. With plenty of time and a little care, that seed can grow into a massive tree, one that provides shade and fruit for decades. When you invest for your child, you're planting that seed in the most fertile soil imaginable—the rich, deep soil of time.

This guide is designed for parents who see the potential beyond a simple savings account and want to unlock real, long-term growth for their kids. We're going to demystify the process of getting that first investment account, like a Custodial Roth IRA, up and running using straightforward concepts you can actually relate to.

The Power of an Early Start

The real magic here is a little something called compound interest. It’s a powerful but simple idea: your investment earnings start generating their own earnings.

Picture a small snowball at the top of a very, very long hill. As it starts to roll, it picks up more snow, getting bigger and moving faster. The longer the hill, the more massive that snowball becomes by the time it reaches the bottom.

When you invest for a kid, you're giving their money a 40, 50, or even 60-year "hill" to roll down. That incredible runway can turn even small, regular contributions into a fortune that would be almost impossible to build if they waited to start in their 20s or 30s.

The core idea of saving and earning interest isn't new. In fact, teaching financial discipline has been seen as vital for centuries. The world's first savings bank, established in Hamburg in 1778, was created to help working people save securely and earn a return. It was all built on the same principles of long-term planning and smart money habits that are crucial for investors today. Learn more about the history of financial literacy.

Giving your child this early advantage offers a few huge benefits:

- Maximizes Compound Growth: Time is the fuel for compounding. The more they have, the better.

- Teaches Financial Habits: It’s a hands-on lesson in patience, planning, and how money works.

- Reduces Future Financial Burdens: A solid financial foundation can make a huge difference for paying for college, buying a first home, or even starting a business down the road.

Making Sense of Core Investment Concepts

To feel confident about managing your child's Roth IRA, you don't need a finance degree. You just need to get comfortable with a handful of key ideas. These four concepts are the bedrock of pretty much every successful, long-term investment strategy.

Let's unpack them with some simple analogies that translate these abstract terms into something you can actually use.

Risk and Return: The Playground Principle

Think about taking your kid to the playground. Not every piece of equipment offers the same thrill—or the same chance of a scraped knee. That's the heart of risk: the possibility that an investment's actual outcome won't be what you expected.

-

Low-Risk (The Sandbox): A savings account or a government bond is like playing in the sandbox. It's safe, predictable, and the odds of losing money are next to nothing. The trade-off? The potential for big gains is just as low. It's steady, but it's not going to get you very far.

-

Higher-Risk (The Swings): Investing in stocks is more like going for the tall swings. You can soar much, much higher, which is exhilarating! That feeling is your return, the profit you make from your investment. But, as any kid knows, you can also swing down just as fast.

The main idea here is that risk and return are two sides of the same coin. If you want the chance for higher returns, you generally have to accept a greater level of risk. For a kid with decades until retirement, taking on calculated risks isn't just okay—it can be a massive advantage.

Diversification: The Toy Bag Strategy

Imagine you're packing a toy bag for a long day at the park. Would you stuff all of your child's absolute favorite toys into one single bag? Probably not. If that one bag gets lost or left behind, the day is pretty much ruined.

That simple idea is diversification. It’s the age-old wisdom of not putting all your eggs in one basket.

The Power of Not Being a Genius

Diversification is your built-in safety net. It means you don't have to perfectly predict which single company will be the next big thing. By spreading your investment across many different companies, industries, or even countries, you reduce the impact if any single one performs poorly.

Instead of trying to pick one winning stock, you can buy a fund that owns tiny slices of hundreds of different companies. If one of those companies hits a rough patch, the others can help pick up the slack. It's a foundational strategy for smart, long-term investing and a key part of the guidance you'll find when investing for minors.

Compounding: The Snowball Effect

We've mentioned this before, but it's so critical it’s worth a second look. Compounding is the real engine that will power your child's account growth over the decades. It's the process where your investment earnings start to generate their own earnings.

Picture a tiny snowball at the top of a very, very long hill.

- The Start: You make an initial investment (the small snowball).

- First Year: It earns a return, picking up a fresh layer of snow and getting a little bigger.

- Next Year: Now the slightly larger snowball rolls, and because it has more surface area, it picks up even more snow.

- Decades Later: This process repeats over and over, with the snowball growing bigger and accelerating faster each year.

For a child, that "hill" is incredibly long—we're talking 50 or 60 years. This massive time horizon is what allows even small, steady investments to grow into something truly significant. It is, without a doubt, the single greatest superpower a young investor has on their side.

Alright, now that you've got the core investment concepts down, it's time to put that knowledge into action. For parents wanting to give their kids a massive head start, one of the most powerful tools out there is the Custodial Roth IRA. It’s the perfect first step for your child's financial journey.

Think of a Custodial Roth IRA as a retirement account for a minor that you, the parent, manage on their behalf. But here's the real magic: it's all about the taxes. Contributions are made with after-tax dollars, meaning every penny of future growth and all qualified withdrawals are 100% tax-free. That’s a game-changer for long-term wealth, allowing decades of compounding to work its wonders completely untouched by the IRS.

So, what’s the catch? It’s a simple but firm rule: your child must have earned income. This doesn't mean they need a formal W-2 from a summer job (though that works!). Legitimate side hustles like babysitting, mowing lawns, or even getting paid for specific, documented tasks in a family business all count. The key is that the pay is reasonable for the work done and you keep good records.

Opening the Account: A Simple Roadmap

Getting an account opened is a lot more straightforward than you might think. It’s just a few key steps from deciding to do it to making that first deposit. Don't let the idea of paperwork intimidate you; these accounts are designed to be accessible.

If you want a full, step-by-step breakdown, you can learn more about how to start a Roth IRA for a child in our complete guide.

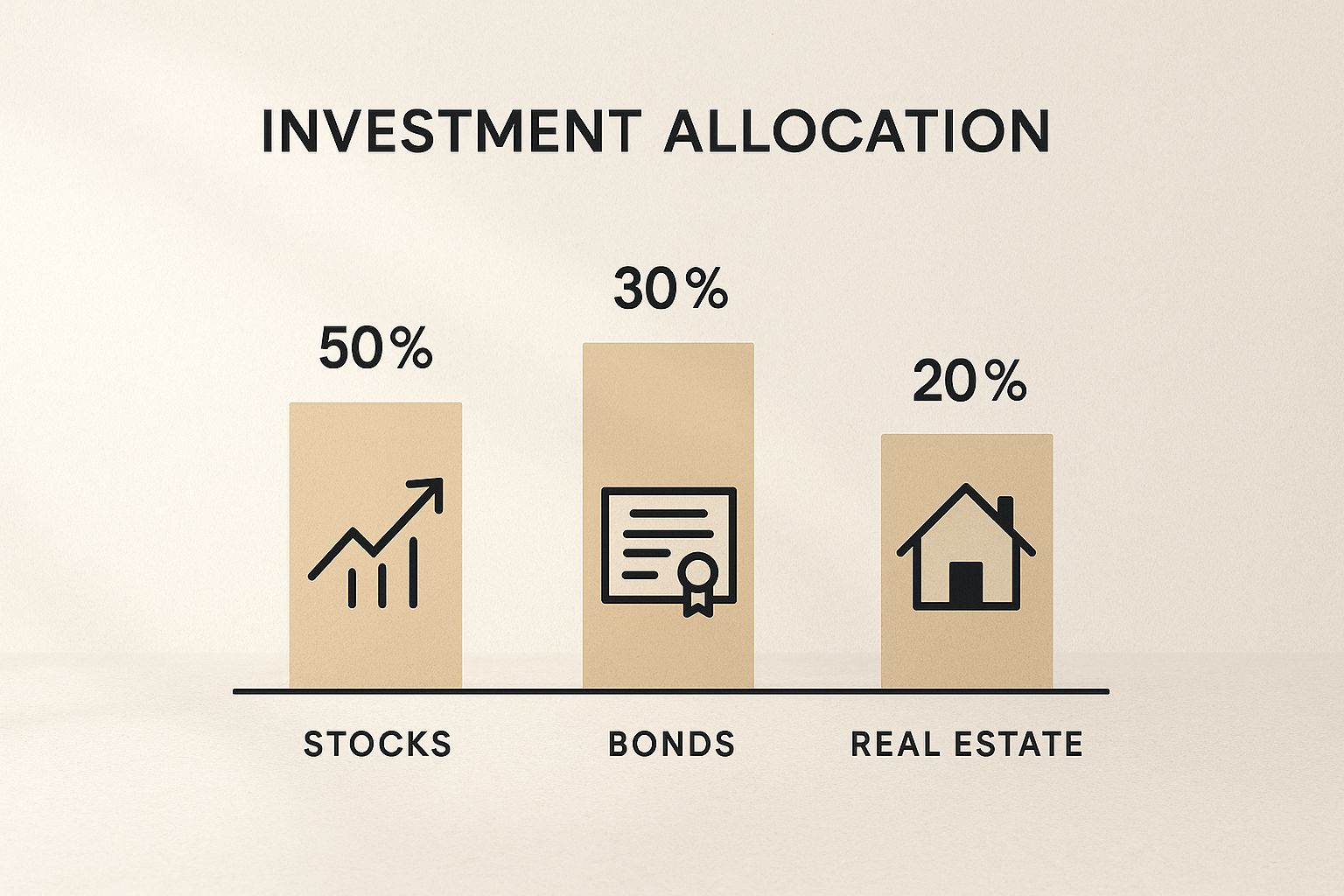

This simple visual breaks down the main types of investments you’ll be choosing from.

These are the foundational building blocks of any solid portfolio—stocks, bonds, and real estate. Each one plays a different role and comes with its own level of risk and potential for growth.

Roth IRA vs. Other Savings Options

Parents often ask how a Roth IRA stacks up against other popular choices, like a 529 college savings plan. While a 529 is great for its specific purpose—paying for education—a Roth IRA offers incredible flexibility. The money you contribute can be pulled out at any time, for any reason, completely tax-free and penalty-free. This turns it into a multi-purpose powerhouse for funding education, a down payment on a first home, or just building an untouchable retirement nest egg.

To give you a clearer picture, we've put together a table comparing the Custodial Roth IRA against a 529 and a standard savings account. This should help you see where each one shines.

Choosing the Right Account for Your Child's Future

| Feature | Custodial Roth IRA | 529 College Savings Plan | Standard Savings Account |

|---|---|---|---|

| Main Goal | Retirement & Flexible Long-Term Savings | Education Savings Only | Short-Term Savings & Easy Access |

| Tax Benefit | Tax-Free Growth & Withdrawals | Tax-Deferred Growth; Tax-Free for Education | Interest Earned is Taxable |

| Who Funds It | Child Must Have Earned Income | Anyone Can Contribute | Anyone Can Contribute |

| Withdrawal Rules | Contributions Anytime; Earnings Restricted | For Qualified Education Only | Anytime, For Any Reason |

As you can see, each account has its place. A savings account is great for immediate needs, and a 529 is a focused tool for college. But for building long-term, flexible wealth that can adapt to your child's changing life goals, the Custodial Roth IRA is in a league of its own.

Building Your Child's First Investment Portfolio

Okay, the Custodial Roth IRA is open and funded. Now you’re probably asking the same question every new investor asks: "So… what do I actually buy?"

The good news? The answer is way simpler than you think. You absolutely do not need to be a stock-picking wizard to build a powerful, effective portfolio for your child.

Forget about chasing hot stocks or trying to time the market. That’s a gambler’s game. Instead, we’re going to focus on a proven, straightforward strategy that values consistency over complexity. For a kid with decades of growth ahead of them, the simplest approach is almost always the best one.

Our entire strategy is built on just two types of investments, perfect for beginners and seasoned pros alike: low-cost index funds and exchange-traded funds (ETFs).

The Power of Owning the Whole Market

Instead of trying to find that one magic needle in the haystack—the next Amazon or Google—what if you could just buy the entire haystack?

That’s the brilliant idea behind an index fund. These funds don't try to beat the market; they aim to be the market. They do this by holding a tiny piece of every single company in a specific market index.

A classic example is an S&P 500 index fund. When you buy a share of this one fund, you instantly own a small slice of 500 of the biggest, most influential companies in the U.S. A total stock market index fund casts an even wider net, giving you exposure to thousands of American companies, from the giants down to the small up-and-comers.

The Set-It-and-Grow-It Mentality

This approach completely removes the stress and guesswork of picking individual stocks. Your child's financial future isn't riding on the success of one or two companies. It's tied to the long-term growth of the entire U.S. or global economy.

This is diversification on autopilot. It’s a core principle of smart investing and the best way to manage risk without overcomplicating things.

Index Funds vs. ETFs: What’s the Real Difference?

You'll hear "index fund" and "ETF" thrown around together a lot, and for good reason. They're incredibly similar, but they have one key difference in how you buy and sell them.

- Index Funds: Think of these as the classic mutual fund. You buy them directly from the fund company (like Vanguard or Fidelity), and the price is set just once at the end of each trading day.

- ETFs (Exchange-Traded Funds): These trade on a stock exchange, just like a share of Apple or Microsoft. Their prices go up and down all day long, and you can buy or sell them anytime the market is open.

Honestly, for a long-term, set-it-and-forget-it account like a child's Roth IRA, either one is a fantastic choice. The best option for you will likely just come down to what your specific brokerage offers. Both give you exactly what you need: low-cost, diversified access to the market.

It also helps to remember just how massive and interconnected the global economy is. To put it in perspective, global foreign direct investment (FDI) flows hit $297 billion in the first quarter of 2024 alone. Seeing that kind of capital move around the world really drives home why owning a broad, diversified fund that captures a piece of that action is such a sound strategy. If you're curious, you can find more global investment statistics and trends.

How to Stay Confident When Markets Fluctuate

Let’s be honest. One of the scariest things for any new investor is watching their account balance drop. Seeing red numbers can trigger a real jolt of panic. But when it comes to your child's account, these ups and downs aren't just normal—they're an expected, and even healthy, part of the long journey.

Think of the stock market as the weather. Some days are sunny and beautiful, others are stormy and turbulent. As a parent teaching investment basics for beginners, your most important role is to be the steady captain of the ship, not abandoning the voyage just because you've hit some choppy seas.

Panic selling during a downturn is like jumping overboard in a storm. It turns a temporary problem into a permanent loss. Your child’s single greatest advantage is their incredibly long time horizon, which gives their investments plenty of runway to ride out any storm and recover.

Turn Downturns into Opportunities

Instead of fearing the dips, a smart approach can actually turn them into an advantage. This strategy is called dollar-cost averaging, and it’s beautifully simple. It just means you invest a fixed amount of money at regular intervals—say, $50 every month—no matter what the market is doing.

Here’s how it works in your favor:

- When prices are high: Your fixed contribution buys fewer shares.

- When prices are low: That same contribution buys more shares.

Over time, this disciplined approach helps you buy more shares at a lower average price than if you tried to guess the "perfect" time to invest. It’s an automatic way to buy low without all the stress and guesswork.

Your Child's Superpower: Time

Remember, a market downturn is just a temporary paper loss until you sell. For an account with a 50-year runway, these periods are merely small blips on a long-term upward trend. Staying invested is precisely how you capture the powerful recovery that has historically followed every dip.

A Global Perspective on Market Movements

It also helps to zoom out and remember that the market is a vast, interconnected system. The daily headlines are just a tiny part of a much larger global economic story. For instance, the sheer scale of international investment is immense. As of early 2025, the U.S. alone had a net international investment position of –$24.61 trillion.

Grasping these massive figures helps put things in perspective. Your small, consistent investments are part of a huge, dynamic global engine. For more context, you can explore the full report on the U.S. international investment position from the BEA.

This long-term mindset is the key to staying confident. By focusing on the decades of growth ahead, not the daily drama, you can confidently steer your child's account through any market weather and keep them on the path to a secure financial future.

Common Questions from Investing Parents

Jumping in and starting a custodial Roth IRA for your child is a massive win. But it's totally normal for that first big step to lead to a new set of very practical, "what-if" questions. You're not just opening an account; you're managing your kid's first real foray into the world of investing.

Let's walk through some of the most common questions we hear from parents in your exact shoes. The goal here is to give you clear, no-nonsense answers so you can feel completely confident about the path you're on.

What Counts as Earned Income for a Child?

This is the big one—the absolute must-know rule for a Roth IRA. But thankfully, it's far more flexible than most parents realize. Your child doesn't need a formal W-2 from a summer job at the local ice cream shop (though that works, too!).

Earned income is simply any money they're paid for actual work they do. Think about it this way:

- Classic Kid Gigs: Babysitting for the neighbors, mowing lawns, walking dogs, or shoveling snowy driveways all count.

- Talent-Based Work: Maybe they're great with tech and can help an older neighbor set up a computer. Or perhaps they give piano lessons to younger kids. That's earned income.

- Family Business Help: If you have your own business, you can absolutely pay your child for legitimate tasks. This could be anything from stuffing envelopes and cleaning the office to modeling for your website's photos.

The whole thing hinges on two key ideas: the pay has to be reasonable for the work they did, and you absolutely must keep good records. You don't need anything fancy—a simple spreadsheet or notebook that tracks the date, the task, how long it took, and how much they were paid is perfect. This is your proof for the IRS.

What Happens When My Child Becomes an Adult?

This is one of the best parts of the whole process. When your child reaches the "age of majority" in your state (usually 18 or 21), the "custodial" part of the account simply falls away.

At that point, control of the Roth IRA automatically transfers to them. The account becomes a standard Roth IRA in their name, and you're no longer the custodian. It’s a huge milestone and a fantastic opportunity to sit down together, look at how far the account has come, and talk about the powerful saving and investing habits you've built together. They're not just inheriting money; they're inheriting the wisdom to manage it for a lifetime.

Can We Use Roth IRA Money for College?

Yes, you can, and this is where the incredible flexibility of the Roth IRA really shines. This is a core concept to grasp when learning investment basics for beginners. You can withdraw your direct contributions—the actual dollars you put in—at any time, for any reason, without paying a dime in taxes or penalties.

Example of a Contribution Withdrawal

Let's say you've contributed a total of $10,000 over the years. You can pull that entire $10,000 back out to help pay for college tuition or a car, and there are zero negative tax consequences.

However, it gets trickier if you want to touch the investment earnings. Pulling out earnings before age 59½ for college can sometimes trigger income taxes, though you can often avoid the 10% penalty. Because of this, many families see the Roth IRA as a dedicated retirement tool and prefer to use other accounts, like a 529 plan, specifically for education.

How Much Should We Contribute Each Year?

Honestly, there's no magic number. The most important thing is just to get started. The amount you can contribute is capped by a simple rule—you can put in the lesser of these two figures:

- Your child’s total earned income for the year.

- The annual IRS maximum contribution limit (for 2024, that's $7,000).

So, if your daughter earns $1,500 from babysitting, you can contribute up to $1,500 for the year. If your son lands a great summer job and earns $8,000, his contribution is capped at that $7,000 IRS limit.

Don't feel pressured to max it out every year. The real power comes from consistency. Even small, regular contributions of $25 or $50 a month can balloon into an unbelievable sum when given decades to compound.

Ready to give your child a multi-decade head start on building wealth? At RothIRA.kids, we provide the tools and jargon-free guidance you need to confidently open and manage a Roth IRA for your child. Explore our free starter guides, income-tracking tools, and practical strategies today. Start building your child's financial future with RothIRA.kids.