Investing for your child is hands-down one of the most powerful financial gifts you can give them. It takes their single greatest advantage—their long time horizon—and puts it to work. We're not just talking about a simple savings account here. This is about harnessing the incredible power of compound growth to potentially turn small, steady contributions into a life-changing nest egg down the road.

Why Investing Early for Your Child Is a Game Changer

Think of it like planting a tree. If you plant one sapling today and another one ten years from now, which one do you think will be bigger and stronger in 30 years? Even if you give them both the same water and sunlight, the first tree wins every time. It just had more time to grow. That’s the simple, powerful idea behind investing for a child.

Time is the secret sauce in any investment recipe. When you start early, even small amounts of money have decades to grow, thanks to the almost magical force of compound interest.

Compound interest is really just "interest earning its own interest." Your original investment earns a return, and then that return starts earning returns of its own. It's a slow snowball at first, but over decades, it can build into an avalanche of growth.

The Power of a Long Runway

Kids have a multi-decade runway before they'll need money for big life events like college or a first home. This long timeline is a massive advantage. It gives their investments plenty of time to ride out the market's natural ups and downs and capture long-term growth. A market downturn that might feel terrifying to someone nearing retirement is just a temporary sale for a child's portfolio—an opportunity to buy more assets at a discount.

Here’s what that long runway really means in practice:

- Serious Wealth Accumulation: Small, regular investments can balloon into a significant sum that could cover college tuition, a down payment on a home, or even seed money for a new business.

- Less Financial Stress Later: By building this financial cushion early, you lighten the load for both you and your child when those major expenses eventually arrive.

- A Priceless Financial Education: The very act of investing for a minor becomes a real-world lesson in financial literacy. It teaches patience, long-term thinking, and the true value of money in a way a textbook never could.

A Foundation for Future Opportunities

Just think about how global investments in children have created massive societal change. According to UNICEF data, nearly half of all primary school-aged kids were out of school in the 1950s. Thanks to decades of sustained investment, that number is less than 10% today. You can read more about how investing in children's futures has changed the world and see the incredible impact for yourself.

Investing for your own child does the same thing on a personal level. This isn't just about piling up dollars and cents; it’s about building a foundation of choice and freedom. You’re giving them a head start that can completely shape their financial future, empowering them to chase their dreams without being held back by money. It's more than a fund; it's a launchpad for their entire life.

Choosing the Right Investment Account for Your Child

Picking the right investment account for your child is a bit like choosing a vehicle for a long road trip. You wouldn’t take a two-seater sports car on a rugged mountain trail, and you wouldn't use a dirt bike for a cross-country highway tour. Each account is a tool built for a specific job, with its own set of rules, benefits, and trade-offs.

The three heavy hitters you’ll hear about most often for investing for minors are Custodial Accounts (UGMA/UTMA), Custodial Roth IRAs, and 529 Plans. Getting a handle on what makes each one tick is the key to matching the right account with your family's hopes for your child’s future.

Custodial Accounts (UGMA and UTMA)

Think of a Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA) account as the all-purpose fund. These are by far the most flexible investment accounts you can open for a kid. As the custodian, you open and manage the account for them, and any money you put in is considered a permanent, irrevocable gift.

The main draw here is freedom. There are no official contribution limits (though massive gifts can trigger gift tax rules), and more importantly, no strings attached to how the money can be used. Once your child hits the age of majority—usually 18 or 21, depending on your state—the money is theirs. Period. They can use it for college, a car, starting a business, or backpacking through Europe.

But that flexibility comes with a couple of big asterisks. First, the investment earnings are taxable under rules often called the "kiddie tax." Second, that complete handover of control at 18 or 21 means you lose your say in how the funds are spent. You have to trust that the young adult you raised will make smart choices.

A custodial account gives you maximum freedom for any life goal, not just education. It's a powerful option, but it requires a leap of faith in your future adult child's judgment.

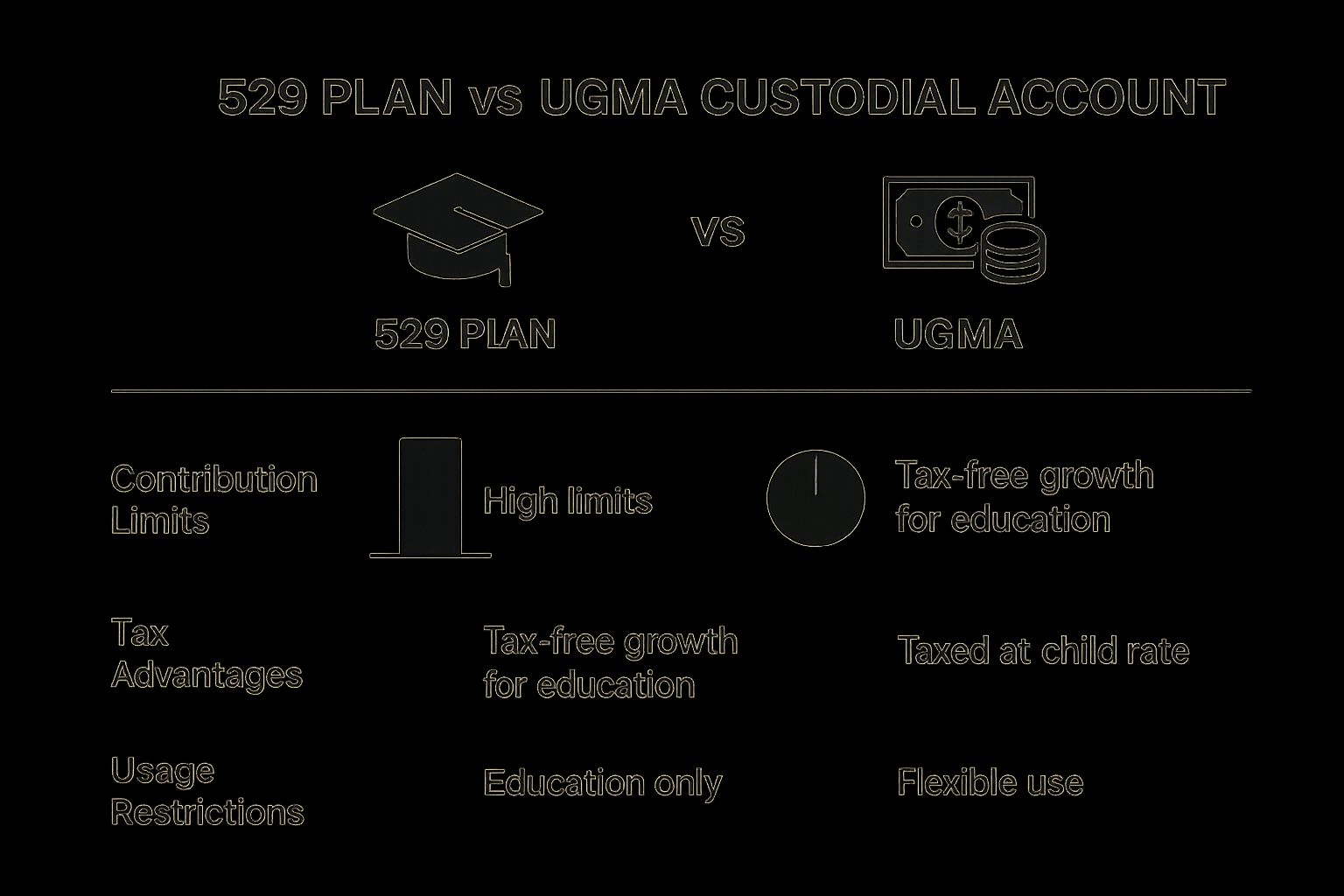

To see how these accounts stack up, this chart gives you a great visual comparison between a flexible UGMA and the more restrictive, education-focused 529 plan.

The central theme is clear: you're almost always trading tax breaks for spending flexibility. Understanding that trade-off is the core of making the right decision.

The Education-Focused 529 Plan

If your number one goal is saving for college or other educational costs, the 529 Plan is a finely tuned machine built just for that purpose. Its superpower is its tax treatment. Your contributions grow tax-deferred, and withdrawals are completely tax-free as long as they're used for qualified education expenses. This covers everything from college tuition and room and board to K-12 private school and even paying off some student loans.

Unlike custodial accounts, the parent (or whoever opens the account) stays in the driver's seat indefinitely. If your kid decides college isn't for them, you can simply change the beneficiary to another eligible family member—including yourself.

Here’s what makes a 529 plan so popular:

- Tax-Free Growth for Education: This is the main event. It lets your investments compound for years without the drag of taxes, giving you a bigger pot of money for school.

- High Contribution Limits: These plans are designed for aggressive saving, allowing you to contribute very large amounts.

- Owner Control: You, the parent, maintain control over the assets, no matter how old your child gets.

The big catch? The restrictions. If you pull money out for anything other than a qualified expense, the earnings are hit with both income tax and a 10% penalty. It's a specialist's tool, not a jack-of-all-trades.

The Powerful Custodial Roth IRA

A Custodial Roth IRA is arguably the most potent long-term wealth-building tool a child can have. It combines tax-free growth with incredible future flexibility, essentially giving them a supercharged retirement account decades before most people even start thinking about one.

The money inside grows completely tax-free, and all qualified withdrawals in retirement (after age 59½) are also tax-free. But here’s the secret weapon: the original contributions can be withdrawn at any time, for any reason, with no taxes or penalties. This acts as an amazing emergency fund or a down payment fund for a young adult.

There's one giant catch, though. The child must have earned income in any year you contribute. You can't just gift them money for their Roth IRA; they need to have a real job, whether that's babysitting, mowing lawns, or working part-time at the family business. The amount you can contribute is capped at their total earnings for the year, up to the annual IRA maximum. For a straightforward way to navigate this, platforms like RothIRA.kids are designed to simplify the setup process for families.

The long-term potential here is just staggering. Even a few thousand dollars invested in a Roth IRA during a child's teen years can snowball into hundreds of thousands—or even over a million dollars—by the time they retire.

To help you see all the options side-by-side, here’s a quick comparison of the key features of each account.

Comparing Investment Accounts for Minors

| Feature | Custodial Account (UGMA/UTMA) | Custodial Roth IRA | 529 Plan |

|---|---|---|---|

| Primary Goal | General savings, flexible use | Retirement, long-term wealth | Education expenses |

| Contribution Source | Gifts from anyone | Child's earned income only | Gifts from anyone |

| Tax on Growth | Taxable ("Kiddie Tax") | Tax-Free | Tax-Deferred |

| Tax on Withdrawals | Taxable (earnings portion) | Tax-Free (in retirement) | Tax-Free (for education) |

| Control of Funds | Transfers to child at 18/21 | Transfers to child at 18/21 | Account owner retains control |

| Spending Rules | No restrictions | Flexible for contributions; rules for earnings | Penalty if not for education |

| Contribution Limit | No limit (gift tax may apply) | Annual IRA max or earned income | Varies by state (very high) |

Choosing the right account really boils down to your primary goal. Are you saving for anything and everything, focusing squarely on education, or trying to give your child the ultimate head start on long-term wealth? Each of these accounts is a fantastic tool when used for the right job.

Unlocking the Kids Roth IRA with Earned Income

When it comes to investing for minors, a Custodial Roth IRA is a true powerhouse, offering the potential for decades of tax-free growth. But there's one golden rule that sets it apart from other accounts, and it’s non-negotiable: the child must have legitimate earned income.

You can’t just hand them birthday money and call it a day. They have to actually earn it. This rule often seems like a dealbreaker for parents, especially those with younger kids. I mean, how can a six-year-old really have a job?

The trick is to understand what the IRS truly considers "earned income." It's a lot broader than you probably think.

Earned income is simply money a person gets for work they perform. For a kid, this could be wages from a formal job, but it's more often pay for self-employment—think mowing lawns, babysitting, or even modeling for the family business's website.

What doesn't count? Passive income. Things like interest from a savings account, stock dividends, or cash gifts won't work here. The money has to be a direct result of their own effort. This distinction is everything when it comes to staying compliant and tapping into the incredible power of a Roth IRA for your child.

What Counts as a Real Job for a Kid?

Don't worry, this isn't about putting your first-grader on a 9-to-5 schedule. The goal is to find real, age-appropriate work they can do for fair pay. The key words here are "legitimate" and "fair market value." The work has to be genuine, and the pay has to make sense for the job done.

Let's think beyond the classic lemonade stand. Here are a few legitimate ways for minors of all ages to start generating income:

- Family Business Gigs: If you own a business, you can absolutely pay your child for real work. This could be anything from modeling for product photos and cleaning the office to helping manage social media posts. As long as the work is necessary for the business, it's fair game.

- Classic Neighborhood Services: These are the timeless, responsibility-building jobs. We’re talking lawn mowing, pet sitting, babysitting, shoveling snow, or running errands for neighbors.

- The Creator Economy: In today's world, kids can earn real money as content creators. If your child has a YouTube channel or a blog that brings in ad revenue or sponsorships, that’s earned income.

- Performing Arts: Kids who act, model, or perform music often earn income that qualifies them for a Roth IRA.

The opportunities are out there if you look for them. The most critical part is ensuring the work is real, the pay is fair, and you keep good records. For a deeper dive, our guide on whether a minor can have a Roth IRA offers even more ideas and details.

Creating a Clear Paper Trail

Think of proper documentation as your best friend. In the unlikely event the IRS ever comes knocking, you need to be able to prove your child's income was legit. This sounds more intimidating than it is—you don't need a team of accountants.

A simple system is all it takes. You're basically just creating a receipt for the work performed. This paper trail is what validates the income and gives you the green light to fund their Roth IRA.

Here’s how to build a solid record:

- Keep a Simple Log: A basic spreadsheet or even a dedicated notebook works perfectly. For each job, just jot down the date, a description of the work, the hours they put in, and how much you paid them.

- Use Invoices: For jobs they do for others (like a neighbor), have your child create a simple invoice. It can list the service, the date, and the total fee. This adds a nice touch of professional legitimacy.

- Pay with a Check or Digital Transfer: While cash is fine, using a check with "for lawn mowing" in the memo line or a digital transfer creates an automatic record. This gives you a clear, third-party trail of the payment from the "employer" (you or a neighbor) to the "employee" (your child).

This little bit of administrative work is what unlocks one of the most powerful investing for minors strategies available. By documenting their hard work, you aren't just staying compliant—you're teaching them a fundamental lesson about the powerful connection between work, earning, and building wealth for the long haul.

How to Open and Fund Your Child's First Investment Account

Alright, you've picked the right account for your child. Now for the fun part: actually opening it. This might sound like you're about to wrestle a mountain of paperwork, but you'll be surprised at how straightforward it is. Most modern brokerages have streamlined investing for minors into a simple online process you can knock out in one sitting.

The whole point of the setup process is to securely and legally verify the identities of both the adult custodian (that’s you) and the minor beneficiary (your child).

Gathering Your Documents

Before you dive into the application, do yourself a favor and get your documents ready. Think of it like prepping your ingredients before you start cooking—it just makes everything smoother and saves you from scrambling later. You'll generally need the same info for both yourself and your child.

For both you and your child, have these details handy:

- Full Name and Date of Birth: The basics for identification.

- Social Security Number: This is non-negotiable for tax reporting on any investment account.

- Physical Address: The account needs to be tied to a real residential address.

As the custodian, you'll also be asked for your employment information and a few standard questions about your investing experience. Don't worry, this is a routine part of opening any brokerage account.

The Step-by-Step Setup Process

With your info at the ready, you can start the application. The good news is that opening a custodial account (like a UGMA/UTMA or a Custodial Roth IRA) is a lot like opening one for yourself.

Here's the typical workflow you can expect:

- Choose Your Brokerage: Pick a firm that offers the account you want. Big names like Fidelity, Charles Schwab, and Vanguard are popular for a reason—they all have a solid range of custodial options.

- Select the Account Type: Once you're on the brokerage's site, find their "Open an Account" section. This is where you need to be specific. Choose "Custodial Account," "UGMA/UTMA," or "Custodial Roth IRA," depending on your goal. If you need a refresher on the Roth setup, you can read our guide on how to start a Roth IRA for a child.

- Enter Custodian and Minor Information: This is where you'll plug in all those personal details you gathered earlier for both you and your child. Take a second to double-check that every name and Social Security Number is perfect to avoid any hiccups.

- Fund the Account: The last step is linking your bank account. This lets you make that first deposit and, more importantly, set up recurring contributions. Automating your strategy is a game-changer. You can usually start with as little as $1 or go up to thousands.

Once the account is open and funded, you’re ready for the most exciting part: making that first investment. This is where the long-term journey of investing for minors truly begins, turning all your preparation into real-world action that puts your child’s money to work.

Building a Simple and Effective Kid-Friendly Portfolio

Alright, the account is open and funded. Now for the exciting part. You’ve reached that moment where you have to ask the big question: what should we actually buy?

When you’re investing for minors, the answer is refreshingly simple. Complexity is the enemy, especially when your child has decades to let their money grow. You don't need to be a stock-picking genius or a frantic day trader. The goal is to build a solid, low-maintenance portfolio that can steadily grow over time without you having to constantly tinker with it.

The “Set It and Forget It” Foundation

The bedrock of any great kid-friendly portfolio is usually a small number of low-cost, broadly diversified funds. Think of it like making a healthy meal. You want a balanced plate with all the essential food groups, not just a pile of candy.

In the investing world, the "essential food groups" are index funds and exchange-traded funds (ETFs). These funds don't try to outsmart the market; they just aim to be the market by holding small pieces of hundreds, or even thousands, of different stocks all in one convenient package.

This approach gives you instant diversification—the golden rule of managing risk. By spreading the money across tons of different companies, you cushion the blow if any single company hits a rough patch. It’s the classic wisdom of not putting all your eggs in one basket.

Make Investing Tangible and Fun

While a broad-market index fund is the sensible core of the portfolio, you can also inject some fun and make the whole thing more engaging for your child. How? By adding a small slice of individual stocks. The key is to pick companies your child actually knows, uses, and maybe even loves.

Does your family have movie nights with Disney+? Are they obsessed with their Apple iPad or begging for the latest Nike sneakers? Buying a few shares of these recognizable companies can transform the fuzzy, abstract concept of "the stock market" into something real and exciting.

It’s an incredible teaching moment. When your child sees they own a piece of a company they admire, they start to grasp what ownership really means. Suddenly, they're not just a customer; they're an owner. That personal connection makes them far more invested—emotionally and financially—in the entire process.

Just remember to keep this "fun" part of the portfolio small. The goal here is education and engagement, not trying to hit a home run on a single stock pick. The heavy lifting should still be done by those steady, diversified funds.

This mirrors a wider principle: early, foundational investments in children yield massive returns. Globally, research shows that over 350 million children lack access to quality childcare. Studies have found that high-quality early childhood programs can produce a return on investment of up to 13% annually through better life outcomes. You can see how these foundational investments create huge long-term value by reading findings from the World Bank. Your financial investment works the same way—a solid foundation is everything.

A Sample Starter Portfolio

So, what does this actually look like? A simple but powerful portfolio for a minor could be structured like this:

- 80% Total Stock Market Index Fund/ETF: This is your core holding, your foundation. It gives you broad exposure to the entire U.S. stock market, capturing its long-term growth potential. It is the ultimate "set it and forget it" investment.

- 20% Individual "Fun" Stocks: This is the slice dedicated to getting your kid excited. Sit down with them and pick 2-4 companies they are genuinely interested in—maybe a video game maker, their favorite restaurant, or a toy company.

This simple two-part structure gives you the best of both worlds. You get the robust, diversified growth from the index fund doing most of the work, while the individual stocks provide a fantastic, hands-on tool for teaching financial literacy. It’s a balanced approach that builds a portfolio that is both smart and sustainable for the long journey ahead.

Using Investing as a Tool for Financial Literacy

Setting up an investment account for your child is about so much more than just money. Think of it as one of the most powerful, hands-on teaching tools you’ll ever have. It takes abstract ideas like compound growth and market swings and makes them real. This turns investing for minors from something you do for them into a shared experience you do with them.

This hands-on approach builds a foundation of financial know-how that a textbook or classroom lesson just can't match. It’s the difference between reading a manual on how a bicycle works and actually getting on and learning to ride.

Making Money a Family Conversation

The first step is often the simplest: just start talking. When you open up about the investment account, you normalize conversations about money, stripping away the mystery and intimidation that so often surrounds finance. You don't need to be a Wall Street whiz—you just need to be their guide.

A great way to start is by reviewing the account statements together. Point out the contributions, the growth, and yes, even the occasional downturns. This simple ritual teaches consistency and transparency from the get-go.

An investment portfolio is the ultimate financial report card. It doesn’t just show numbers; it tells a story of patience, discipline, and the incredible power of time. Use it to tell that story with your child.

These regular check-ins create a safe space for questions and build a lifelong habit of financial awareness. It's a routine that can serve them well into adulthood.

Explaining Complex Ideas Simply

Talking about market dips can be a fantastic learning moment. Instead of a reason to panic, you can frame it as the stock market being "on sale." This simple shift in perspective teaches a crucial lesson in long-term thinking and emotional discipline—two skills every successful investor needs.

For younger kids, simple analogies are your best friend:

- Compound Growth: I like to call this the "money snowball." A small snowball rolling down a hill picks up more snow, getting bigger and faster as it goes. Your money works the same way, with its earnings generating their own earnings over time.

- Diversification: Compare it to ordering a pizza. You wouldn't want a pizza with only one topping, right? What if you don't like it? A good portfolio, like a good pizza, has lots of different ingredients (companies and industries) to make it more balanced and resilient.

These lessons are essential. The value of this education and the stable financial footing it can provide can't be overstated, especially when you look at the bigger picture. Globally, about 272 million children are out of school, partly because their countries face financial instability that hamstrings spending on education. You can learn more about how economic pressures impact kids' futures from these findings by Save the Children.

By teaching financial literacy at home, you’re giving your child a powerful tool to navigate their own economic journey with confidence and skill.

Answering Your Top Questions About Investing for Minors

Getting started with investing for your kids always brings up a few questions. Let's walk through some of the most common ones that come up for parents and guardians.

What Happens to a Custodial Account When My Child Turns 18?

This is a big one, and it’s critical to understand from day one. When your child hits the age of majority in your state—which is usually 18 but sometimes 21—the "custodial" part of the account legally dissolves. The money becomes theirs, full stop.

At that moment, control of the account and every asset inside it transfers completely and irrevocably to them. They can do whatever they want with it, whether that's paying for tuition, buying a car, or funding a gap year in another country. As the former custodian, you no longer have a legal say, which is exactly why teaching financial responsibility as the account grows is just as important as the investing itself.

Can Grandparents Contribute to My Child’s Account?

They absolutely can! It’s a fantastic way for grandparents or other relatives to give a gift that truly keeps on giving. Anyone is allowed to contribute funds to a custodial account (like a UGMA or UTMA) or a 529 plan set up for your child.

Think about it this way: instead of another toy that gets forgotten in a few months, family members can give a gift that has the potential to grow for decades. This makes these accounts an incredible tool for collective family support, directly building your child’s financial foundation.

What Is the Kiddie Tax and How Does It Work?

The "kiddie tax" is simply an IRS rule to stop wealthy families from dodging taxes by shifting their investment income over to a child who's in a much lower tax bracket.

Here’s the breakdown for 2024:

- The first $1,300 of your child's unearned income (things like investment dividends or capital gains) is completely tax-free.

- The next $1,300 is taxed, but at the child's own low income tax rate.

- Any unearned income above $2,600 gets taxed at the parents' higher marginal tax rate.

This rule generally kicks in for kids under 19, or under 24 if they're a full-time student.

Is There a Minimum Amount to Start Investing?

Nope! This is one of the best parts about getting started today. Nearly all of the big brokerages have gotten rid of account minimums. You can open an account with $0 and start investing with as little as $1 using fractional shares. What matters is starting and being consistent, not how much you begin with.

Ready to give your child a decades-long head start on building wealth? At RothIRA.kids, we provide the tools and guidance to make it happen. Explore our free guides and resources to start your journey today.