Starting an investment journey for your child is one of the most powerful gifts you can give, unlocking decades of potential growth through the magic of compounding. But with so many options, choosing the right platform can feel complex. This is where custodial investment accounts, such as UGMAs and UTMAs, provide a solution. They allow you to invest on behalf of a minor, giving them a significant head start on building wealth for college, a first home, or even retirement.

This guide cuts through the noise to help you find the best custodial investment accounts for your family's specific needs. We've done the research for you, providing a detailed, side-by-side comparison of the top platforms available today. You will find a clear breakdown of each provider, including Fidelity, Schwab, Vanguard, Acorns Early, and more.

Inside, we dive into the critical details: fee structures, investment options, user experience, and unique features that set each service apart. Each review includes screenshots and direct links, making it simple to get started. By the end of this article, you will have a clear, actionable path to selecting the perfect account to begin building your child's financial future.

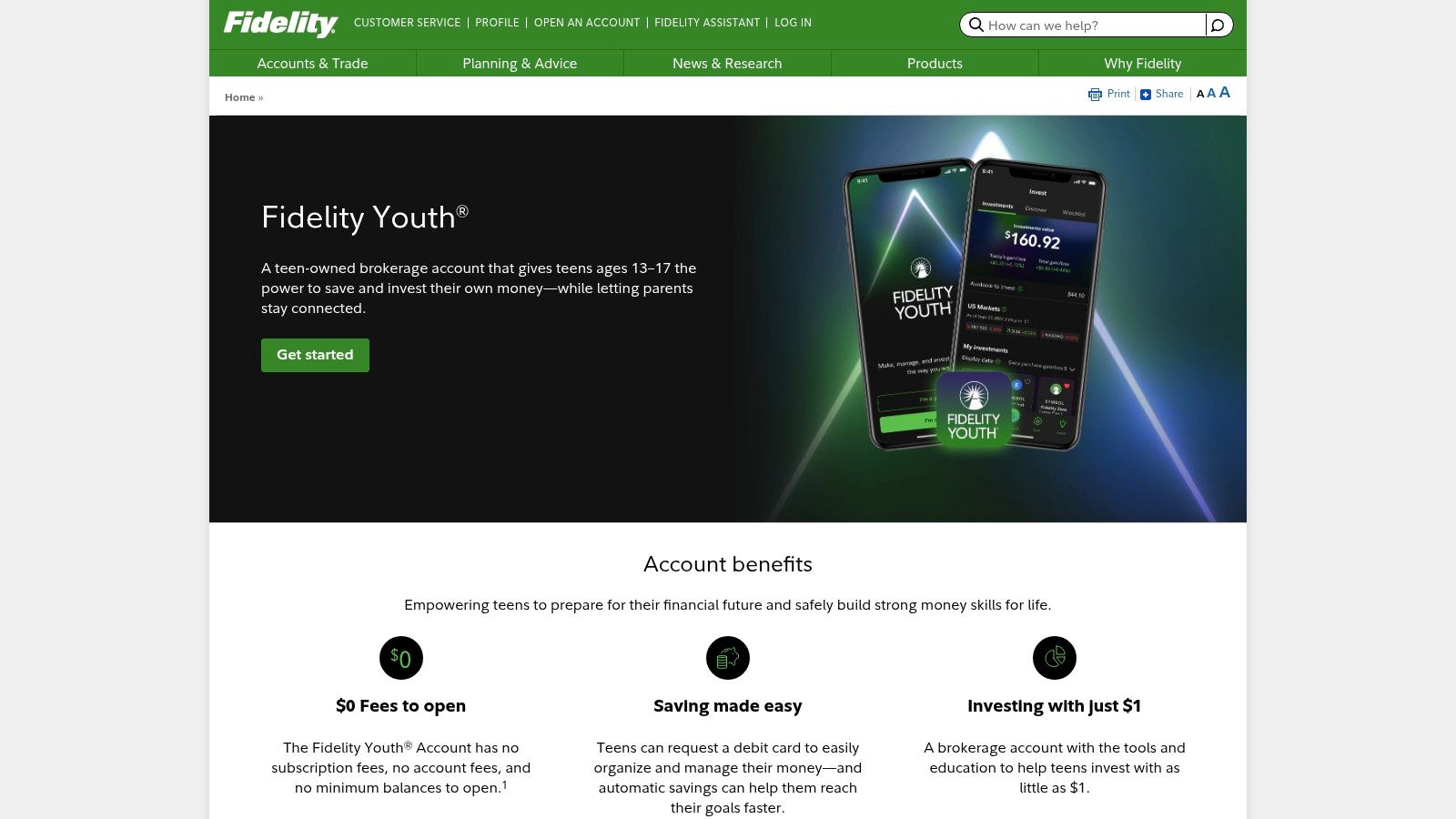

1. Fidelity Investments

Fidelity stands out as a financial powerhouse, offering some of the best custodial investment accounts available due to its comprehensive features, lack of fees, and robust platform. It caters to a wide audience, from parents just starting their child’s investment journey to seasoned investors looking for sophisticated tools. The platform’s strength lies in its blend of accessibility and depth, making it a top contender for long-term family financial planning.

The account opening process is straightforward, requiring no minimum deposit to get started. This removes a significant barrier to entry, allowing parents to begin investing with any amount they're comfortable with. Once established, the account provides access to a vast universe of investment choices, including individual stocks, bonds, ETFs, and thousands of mutual funds.

Key Features and Benefits

Fidelity’s commitment to low-cost investing is a major draw. There are no account maintenance fees, no minimum balance requirements, and commission-free online trading for U.S. stocks and ETFs. This fee structure ensures that more of your money goes toward building your child's future, not paying the brokerage.

A unique offering is the Fidelity Youth Account, designed for teens aged 13 to 17. This account allows teens to learn about spending, saving, and investing with their own debit card and brokerage access, all under parental supervision. It serves as an excellent educational tool, providing hands-on experience in financial management before they reach adulthood. Explore more options for children's investment accounts to see how Fidelity's offerings compare.

Who It's Best For

Fidelity is ideal for parents who want a one-stop-shop solution. Whether you prefer a hands-on approach using their extensive research tools to pick individual stocks or a more passive strategy with their proprietary index funds, the platform has you covered.

Pros:

- Zero Fees: No account fees or minimums to open a custodial account.

- Vast Investment Selection: Access to stocks, ETFs, mutual funds, and fractional shares.

- Educational Focus: The Fidelity Youth Account and extensive learning resources empower young investors.

- Excellent Support: Strong customer service and a user-friendly interface.

Cons:

- Limited Robo-Advisory: Automated portfolio management services are not directly available for standard custodial accounts.

For a powerful, fee-free platform that can grow with your child from infancy through their teenage years, Fidelity presents a compelling and versatile choice.

Website: https://www.fidelity.com/go/youth-account/overview

2. Charles Schwab

Charles Schwab offers one of the best custodial investment accounts for those who value a blend of digital convenience and human support. The Schwab One Custodial Account is a powerful, low-cost option that provides extensive investment choices and top-tier customer service. It's an excellent choice for parents who want a full-service brokerage experience with no account fees or minimums, making it highly accessible for families just beginning to invest for their child.

The account setup is streamlined and does not require an initial deposit, removing a common barrier for new investors. Once active, custodians gain access to a broad market of investment products, including stocks, ETFs, mutual funds, and bonds. This flexibility allows parents to tailor a portfolio that aligns perfectly with their long-term financial goals for their child.

Key Features and Benefits

Schwab’s commitment to low-cost investing is a significant advantage. The account features no monthly service fees, no opening or maintenance fees, and commission-free online trading for stocks and ETFs. This ensures that your contributions are maximized for growth rather than being eroded by charges.

A standout feature is Schwab Stock Slices, which allows you to buy fractional shares of any company in the S&P 500 for as little as $5. This makes it possible to build a diversified portfolio of well-known companies, even with a small amount of capital. Furthermore, Schwab’s robust trading platforms and 24/7 customer support provide an exceptional user experience, whether you're a novice or an experienced trader.

Who It's Best For

Charles Schwab is perfect for parents who want the option of in-person guidance. The extensive network of physical branches offers a personal touch that purely online brokers cannot match. It’s also great for those who want to start small, as Schwab Stock Slices make blue-chip stocks accessible to any budget.

Pros:

- Strong Customer Service: Renowned 24/7 support via phone, chat, and in-person at physical branches.

- Fractional Shares: Schwab Stock Slices allow for easy diversification with small investment amounts.

- No Fees or Minimums: Eliminates barriers to opening and maintaining a custodial account.

- Robust Trading Platforms: Tools suitable for both beginner and advanced investors.

Cons:

- High Robo-Advisory Minimum: Schwab Intelligent Portfolios, their robo-advisory service, requires a $5,000 minimum investment.

For parents seeking a trusted brokerage with a strong support system and the flexibility of both online and in-person service, Charles Schwab offers a comprehensive and user-friendly solution.

Website: https://www.schwab.com/ira/custodial-ira

3. Vanguard

Vanguard has built its reputation on a foundation of low-cost, long-term investing, making it a stellar choice for parents seeking to establish one of the best custodial investment accounts. The platform is synonymous with passive investment strategies, championing the idea that consistent, diversified investing over time is the key to building wealth. This philosophy is perfectly suited for a child's lengthy investment horizon, making Vanguard a trusted partner for family financial goals.

Opening a custodial account (UGMA/UTMA) with Vanguard is a deliberate step toward disciplined investing. While the platform may not have the flashy interface of some newer fintech companies, its strength lies in its steadfast focus on what matters most: minimizing costs to maximize returns. Investors gain access to Vanguard’s world-renowned lineup of mutual funds and ETFs, most of which can be traded commission-free.

Key Features and Benefits

Vanguard’s primary advantage is its unwavering commitment to low costs. You can avoid account service fees by simply signing up for electronic delivery of statements and other documents. The core of the offering is access to Vanguard’s broad selection of mutual funds and ETFs, which are famous for their rock-bottom expense ratios. This means a larger portion of your investment's earnings are reinvested for growth rather than being eroded by fees.

The platform is built for the buy-and-hold investor. It provides a wealth of educational materials and market insights that reinforce the principles of long-term financial planning. This approach helps custodians stay the course during market volatility, which is a critical lesson to pass on to the next generation of investors.

Who It's Best For

Vanguard is the ideal platform for parents who believe in passive investment strategies and want to set up a low-maintenance, "set-it-and-forget-it" portfolio for their child. It appeals to investors who prioritize low fees and a proven track record over high-tech trading tools.

Pros:

- Low-Cost Investing: Access to funds with some of the lowest expense ratios in the industry.

- Passive Strategy Focus: Excellent for building a diversified, long-term portfolio with index funds.

- Strong Reputation: Known for its investor-first ethos and transparency.

- No Account Fees: Account service fees are waived with e-delivery.

Cons:

- Minimum Investments: Some popular Vanguard mutual funds require an initial investment of $3,000.

- Limited Fractional Shares: Fractional share investing is primarily limited to Vanguard ETFs.

For parents who want to instill the time-tested values of patient and disciplined investing, Vanguard provides a powerful and cost-effective platform to build a strong financial future for their child.

Website: https://investor.vanguard.com/account-types/custodial

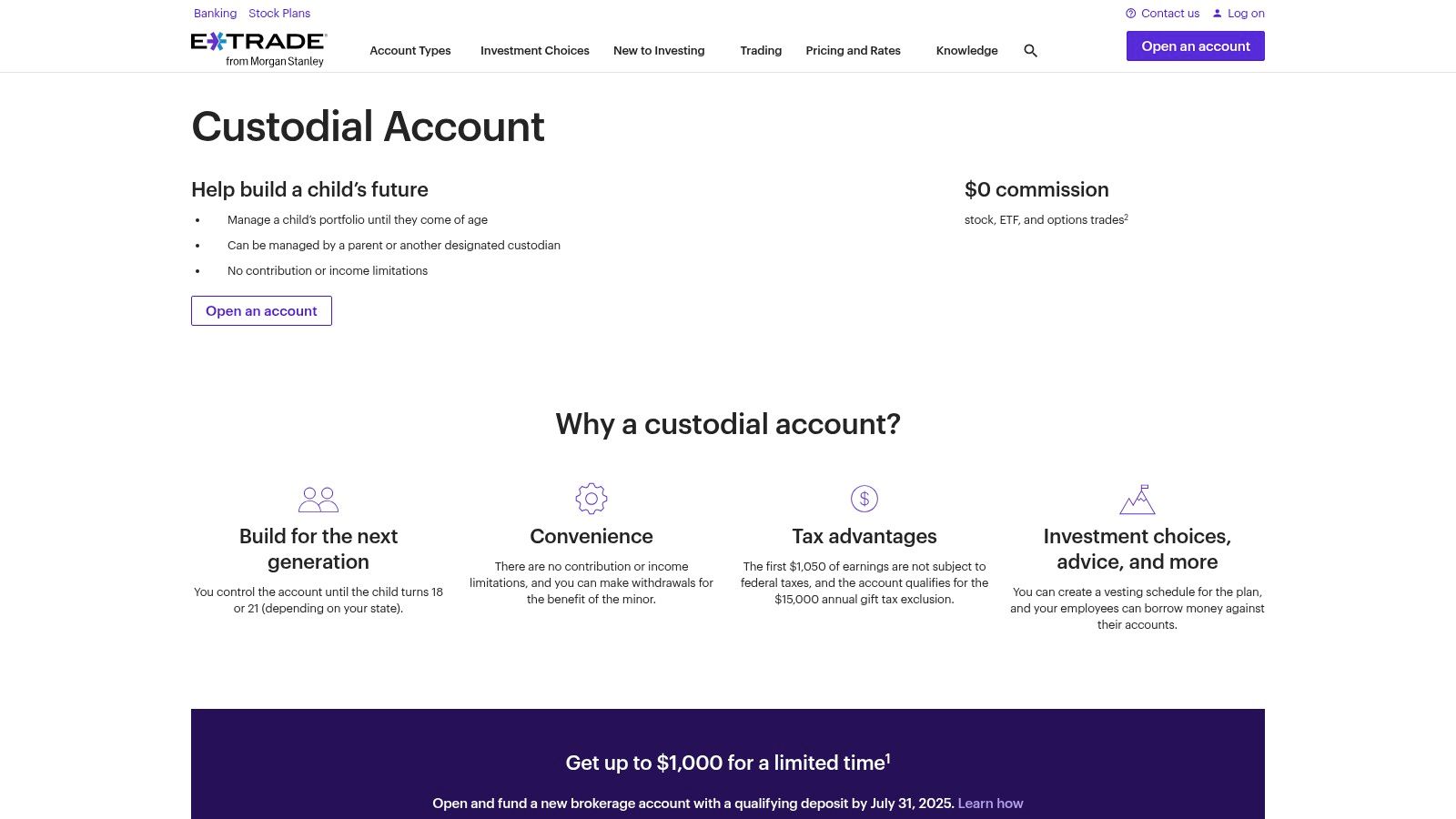

4. E*TRADE

E*TRADE secures its spot among the best custodial investment accounts by offering a powerful blend of investment options, advanced trading tools, and integrated banking services. Acquired by Morgan Stanley, it caters to parents who want a comprehensive platform that can handle everything from simple, long-term investing to more complex trading strategies, like options. This makes it an excellent choice for financially savvy guardians looking to actively manage their child's portfolio.

The platform is highly accessible, with no account maintenance fees or minimum deposit requirements for its custodial accounts. This allows parents to open an account and start investing for their child's future without a large initial outlay. E*TRADE provides a vast selection of investment products, ensuring you can build a diversified portfolio tailored to your long-term goals.

Key Features and Benefits

E*TRADE stands out by combining robust investment capabilities with practical banking features. You'll find commission-free online trading for U.S. stocks and ETFs alongside a massive selection of no-transaction-fee mutual funds. A key differentiator is the ability to trade options within the custodial account, a feature not commonly offered by all competitors.

For those who prefer a more hands-off approach, E*TRADE offers its Core Portfolios robo-advisory service. With a $500 minimum investment, this service will build and manage a diversified portfolio for you, though it comes with a 0.30% annual advisory fee. The account can also be linked to a free debit card and online bill pay, seamlessly integrating your child's savings and investment activities.

Who It's Best For

E*TRADE is best suited for parents who are comfortable with investing and may want access to more advanced tools and a wider range of securities, including options. It's also a great fit for families who value the convenience of having their banking and investing services consolidated on a single, powerful platform.

Pros:

- Comprehensive Tools: Access to two trading platforms (Power E*TRADE and the standard platform) with advanced charting and research.

- Wide Investment Selection: Extensive choice of stocks, ETFs, and thousands of no-transaction-fee mutual funds.

- Integrated Services: Combines investing with banking features like a debit card and bill pay for a unified financial hub.

Cons:

- Robo-Advisory Fee: Core Portfolios requires a $500 minimum and charges a 0.30% annual management fee.

- Limited Fractional Shares: Fractional share investing is not as widely available as on some competing platforms.

For parents seeking a feature-rich environment that supports both active trading and passive investing strategies, E*TRADE offers a compelling and versatile solution.

Website: https://us.etrade.com/what-we-offer/our-accounts/custodial-account

5. Merrill Edge

Merrill Edge, backed by the financial strength of Bank of America, offers some of the best custodial investment accounts for those who value integrated banking and investing. It provides a powerful platform with robust research tools, making it an excellent choice for parents looking to manage their family's finances under one roof. The seamless connection between banking and brokerage services simplifies funding the account and managing overall financial health.

Opening a custodial account is simple and accessible, with no minimum deposit required to start. This feature makes it easy for families to begin investing for their child's future, regardless of their starting capital. Once the account is open, investors gain access to a wide array of investment options, including stocks, ETFs, mutual funds, and even more complex instruments like options.

Key Features and Benefits

A major advantage of Merrill Edge is its cost-effective structure. Custodial accounts come with no annual fees, no minimum balance requirements, and commission-free online trading for U.S. stocks and ETFs. This ensures that your investment grows efficiently without being diminished by unnecessary costs.

The platform's standout feature is its deep integration with Bank of America. This allows for instant fund transfers between your checking and investment accounts, providing unparalleled convenience. For those seeking a more hands-off approach, Merrill Guided Investing offers a robo-advisory service that can build and manage a portfolio tailored to your child's long-term goals, although this service comes with an annual fee.

Who It's Best For

Merrill Edge is a perfect fit for existing Bank of America customers or parents who appreciate the convenience of a fully integrated financial ecosystem. It also appeals to investors who want access to high-quality research and the option of professional guidance from a financial advisor.

Pros:

- Seamless Banking Integration: Instant transfers and a unified view for Bank of America customers.

- No Fees or Minimums: Custodial accounts are free of annual fees and don't require a minimum deposit.

- Comprehensive Research: Access to top-tier market analysis and educational resources.

- Guided Investing Option: Robo-advisory services are available for automated portfolio management.

Cons:

- Limited Fractional Shares: The platform does not offer fractional share investing for individual stocks.

- Robo-Advisor Fees: The guided investing service has higher annual fees than some specialized competitors.

For families seeking a sophisticated platform with strong research tools and the convenience of integrated banking, Merrill Edge offers a compelling and streamlined solution.

Website: https://www.merrilledge.com/investment-accounts/custodial-account

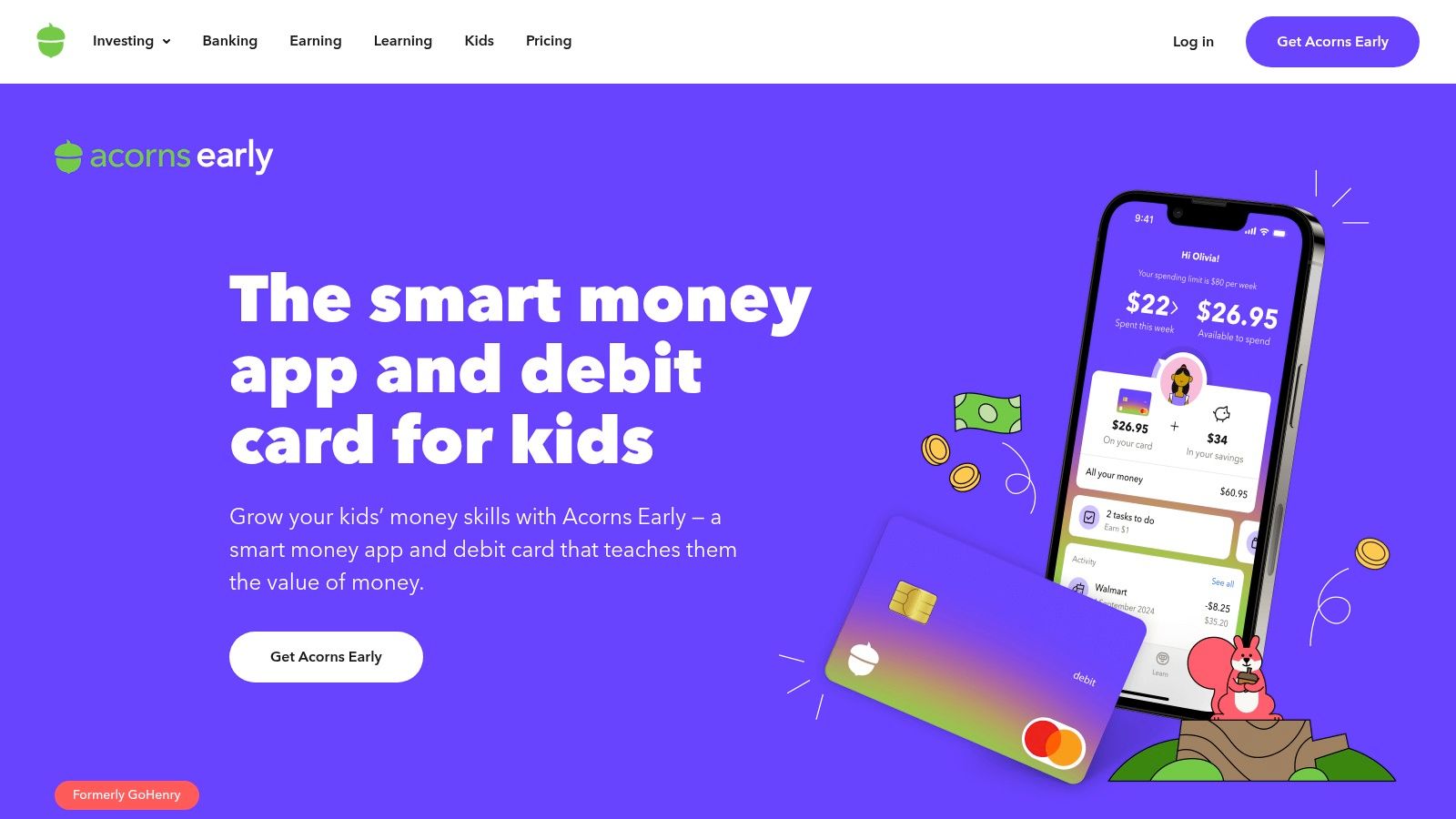

6. Acorns Early

Acorns Early simplifies the process of investing for children by integrating it seamlessly into daily life. It is designed for parents who appreciate a "set it and forget it" approach, using automation to build a nest egg for their child with minimal effort. The platform’s strength lies in its user-friendly mobile app and its unique Round-Ups feature, making it one of the most accessible custodial investment accounts for busy families.

The service is part of the broader Acorns subscription model, which means a single flat monthly fee grants you access to Acorns Early along with other investment, retirement, and checking accounts. This structure allows you to add multiple children to your plan at no extra cost, making it a scalable solution for growing families. Getting started requires no minimum deposit, removing initial barriers to entry.

Key Features and Benefits

Acorns Early stands out with its automated investing tools. The popular Round-Ups feature automatically invests the spare change from your daily purchases, turning small, consistent actions into significant long-term growth. You can also set up recurring daily, weekly, or monthly investments to ensure consistent contributions to your child's portfolio.

Investments are placed in one of five diversified ETF portfolios, ranging from conservative to aggressive, based on your risk tolerance and time horizon. While this limits customization, it simplifies decision-making for those who prefer not to pick individual stocks. The platform also includes educational content called Acorns Grow, designed to help families learn about financial principles together. Discover more about the fundamentals of investing for minors to complement the lessons within the app.

Who It's Best For

Acorns Early is ideal for parents who value simplicity and automation over granular control. It is perfect for those new to investing or anyone looking to effortlessly build savings for their children without having to actively manage a portfolio.

Pros:

- Effortless Automation: Round-Ups and recurring deposits make saving and investing a background habit.

- User-Friendly Interface: The mobile app is exceptionally intuitive and easy to navigate.

- All-in-One Pricing: A flat monthly fee covers multiple custodial accounts and other financial tools.

- Educational Content: Provides resources to help build financial literacy for the whole family.

Cons:

- Monthly Fee: The flat fee can be disproportionately high for accounts with very small balances.

- Limited Investment Choices: You cannot select individual stocks or ETFs; you must use their pre-built portfolios.

For hands-off investors seeking a brilliantly simple way to start investing for their kids, Acorns Early offers a powerful and modern solution.

Website: https://www.acorns.com/early/

7. UNest

UNest positions itself as a modern, family-focused financial app, simplifying how parents save and invest for their children's futures. It moves away from the traditional brokerage model, offering a streamlined, goal-oriented experience designed for busy parents who value simplicity and community. By blending managed investing with unique gifting features, UNest makes building a nest egg for a child an easy and collaborative effort.

The platform is built around a user-friendly mobile app, where setting up a custodial account takes just minutes. Rather than asking parents to pick individual stocks, UNest provides five managed investment portfolios, including options that prioritize socially responsible companies. This approach removes the guesswork, making it one of the most accessible options for those new to investing.

Key Features and Benefits

UNest's standout feature is its powerful gifting platform. Parents can generate a unique link to share with friends and family, allowing them to contribute directly to the child's investment account for birthdays, holidays, or other milestones. This feature turns saving into a communal activity and can significantly accelerate account growth.

Another key benefit is its rewards program. By shopping with partner brands through the UNest app, parents can earn cash-back rewards that are automatically invested into their child’s account. The platform also includes educational content to help both parents and children build financial literacy. However, it's important to note that UNest operates on a subscription model, with a monthly fee of $4.99 for the UNest Investment plan.

Who It's Best For

UNest is a perfect fit for parents who want a "set it and forget it" investment solution and love the idea of involving friends and family. Its simplicity is ideal for those who feel overwhelmed by the complexity of traditional brokerage platforms and prefer a guided, mobile-first experience.

Pros:

- Simplified Investing: Easy-to-understand managed portfolios remove the stress of stock picking.

- Crowdsourced Contributions: Unique gifting feature encourages community involvement in the child's financial future.

- Financial Education Focus: App includes resources to boost financial literacy.

- Rewards Program: Earn money for your child's account by shopping with partner brands.

Cons:

- Subscription Fee: The $4.99 monthly fee can be costly, especially for smaller account balances.

- Limited Investment Control: Users cannot choose individual stocks or ETFs.

For families seeking one of the best custodial investment accounts with a strong community and educational angle, UNest offers a compelling, modern alternative.

Website: https://www.unest.co/

Top 7 Custodial Investment Accounts Comparison

| Custodial Account | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Fidelity Investments | Moderate, requires self-directed setup | Low (no fees, broad assets access) | Diversified portfolio growth and learning | Beginners to experienced investors, youth | No fees, fractional shares, strong education |

| Charles Schwab | Moderate, user-friendly platforms | Low (no fees, 24/7 support) | Steady growth with customer support | Investors needing support and branch access | Commission-free trades, physical branches |

| Vanguard | Low to moderate, passive investing focus | Low (no service fees, fund minimums) | Long-term low-cost investing | Long-term investors seeking low cost | Low-cost funds, strong investor advocacy |

| E*TRADE | Moderate, includes banking integration | Moderate (robo minimum $500, fees 0.3%) | Broad portfolio growth with automation | Investors wanting banking + investing combo | Robo advisory, banking features |

| Merrill Edge | Moderate, robo-advisory with banking links | Moderate (robo fees higher, no minimums) | Seamless banking and investing | Bank of America customers | Integrated banking, financial advisors |

| Acorns Early | Low, fully automated investing | Moderate (flat monthly fee) | Automated savings and investing habits | Families starting small with automation | Automation, round-ups, family education |

| UNest | Low, simple setup with managed portfolios | Moderate (monthly fee $4.99) | Goal-oriented investing with education | Families seeking guided investing and gifts | Socially responsible options, community |

From Account Selection to Action: Your Next Steps

Choosing from the best custodial investment accounts is a foundational move, but the journey toward securing your child's financial future has just begun. The true power lies not just in the selection, but in consistent action, strategic funding, and ongoing financial education. You've now seen the detailed landscape, from the expansive investment options at Fidelity and Schwab to the low-cost index fund philosophy of Vanguard and the user-friendly interfaces of Acorns Early and UNest.

The most critical insight is that the 'perfect' account is simply the one you open and actively use. Delaying the decision in search of an elusive ideal can be more costly than choosing a very good option today, due to the lost time for compound growth. Your next step is to transition from analysis to implementation.

How to Choose the Right Account for Your Family

Making the final decision can feel overwhelming, so let's distill it into a simple, actionable framework. Instead of getting lost in minor feature differences, focus on what truly matters for your specific situation.

Consider these key questions to guide your choice:

- Are you a hands-on investor or do you prefer a set-it-and-forget-it approach? If you enjoy research and portfolio management, a traditional brokerage like Fidelity, Charles Schwab, or E*TRADE offers the flexibility you need. If you value simplicity and automation, a platform like Acorns Early might be a better fit.

- What are the primary investment types you plan to use? For those committed to a low-cost, diversified strategy centered on ETFs and mutual funds, Vanguard is an industry standard. If you want access to a broader universe of stocks, bonds, and other securities, a full-service broker is superior.

- How important are fees and account minimums to you? While most major brokerages have eliminated commissions and account fees on standard custodial accounts, be mindful of underlying fund expenses (expense ratios). Compare these costs across the specific ETFs or mutual funds you plan to purchase.

- Do you already have a banking or investment relationship? Consolidating accounts with a provider you already use, like Merrill Edge for Bank of America customers, can streamline transfers and simplify your financial life.

Beyond the Account: Implementation and Education

Once your account is open, the real work starts. The most successful strategies involve creating an automated system. Set up recurring automatic transfers from your bank account, even if it's a small amount. This consistency is the engine of long-term wealth creation.

Key Takeaway: The single most important factor after opening an account is establishing an automated, recurring investment schedule. This removes emotion and effort from the process, ensuring you are consistently buying assets and benefiting from dollar-cost averaging over time.

Furthermore, use this account as a teaching tool. As your child gets older, involve them in the process. Show them the account statements, explain what a stock or an ETF is, and discuss the power of compounding. This hands-on financial literacy lesson is an invaluable gift in itself, transforming an abstract financial vehicle into a tangible and exciting learning experience. This journey is not just about building wealth for your child; it's about building a financially capable adult.

Ready to take your child's financial future to the next level? If your child has earned income from a summer job, a family business, or their own entrepreneurial venture, they may be eligible for a Custodial Roth IRA. RothIRA.kids provides a step-by-step system to help you legally document your child's income and compliantly open a powerful, tax-free retirement account. Visit RothIRA.kids to learn how to unlock this advanced wealth-building strategy.